Question: Question 15 please Question 15 4 pts A mutual fund manager has a $40 million portfolio with a beta of 1.00. The risk-free rate is

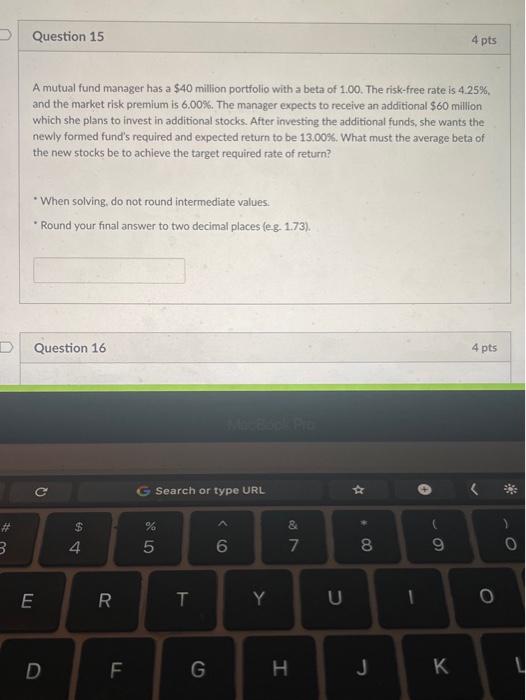

Question 15 4 pts A mutual fund manager has a $40 million portfolio with a beta of 1.00. The risk-free rate is 4.25% and the market risk premium is 6.00%. The manager expects to receive an additional $60 million which she plans to invest in additional stocks. After investing the additional funds, she wants the newly formed fund's required and expected return to be 13.00%. What must the average beta of the new stocks be to achieve the target required rate of return? When solving, do not round intermediate values. * Round your final answer to two decimal places le g. 173). D Question 16 4 pts c G Search or type URL * $ % 0) > & 7 3 4 5 8 9 o E R T Y U 0 D F G H J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts