Question: question 15 , question 13 included below is for refrence. why 15. (Organizing cash flows, NPV, IRR) This problem follows Problem 13. It is now

question 15 , question 13 included below is for refrence.

question 15 , question 13 included below is for refrence.

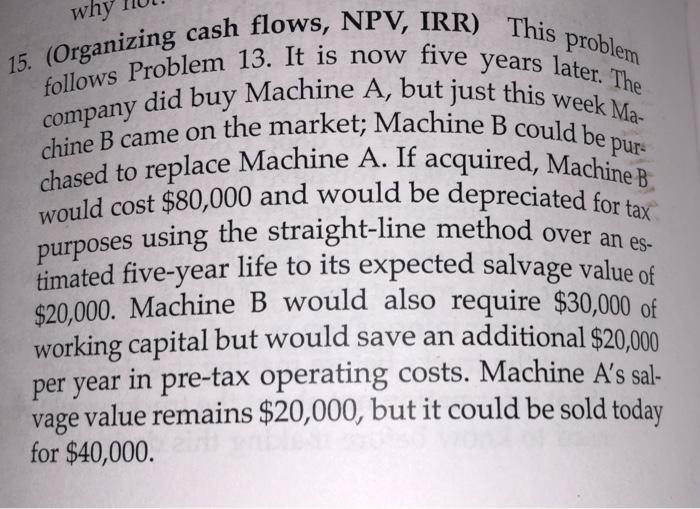

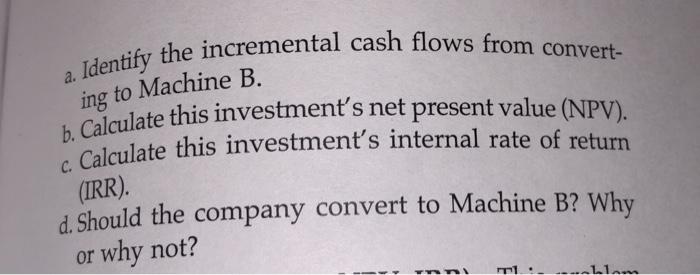

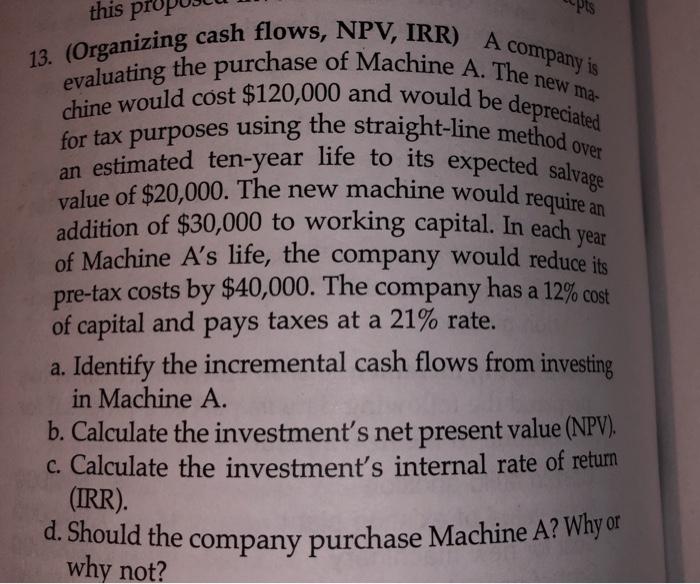

why 15. (Organizing cash flows, NPV, IRR) This problem follows Problem 13. It is now five years later. The company did buy Machine A, but just this week Ma- chine B came on the market; Machine B could be pur- chased to replace Machine A. If acquired, Machine B would cost $80,000 and would be depreciated for tax purposes using the straight-line method over an es. timated five-year life to its expected salvage value of $20,000. Machine B would also require $30,000 of working capital but would save an additional $20,000 per year in pre-tax operating costs. Machine A's sal- vage value remains $20,000, but it could be sold today for $40,000. year this pro 13. (Organizing cash flows, NPV, IRR) A company is evaluating the purchase of Machine A. The new ma- chine would cost $120,000 and would be depreciated for tax purposes using the straight-line method over an estimated ten-year life to its expected salvage value of $20,000. The new machine would require an addition of $30,000 to working capital. In each y of Machine A's life, the company would reduce its pre-tax costs by $40,000. The company has a 12% cost of capital and pays taxes at a 21% rate. a. Identify the incremental cash flows from investing in Machine A. b. Calculate the investment's net present value (NPV). c. Calculate the investment's internal rate of return (IRR). d. Should the company purchase Machine A? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts