Question: Question 16 0/1 pts You wrote a put option on 100 shares of Tesla with a strike price of $57 and at a premium of

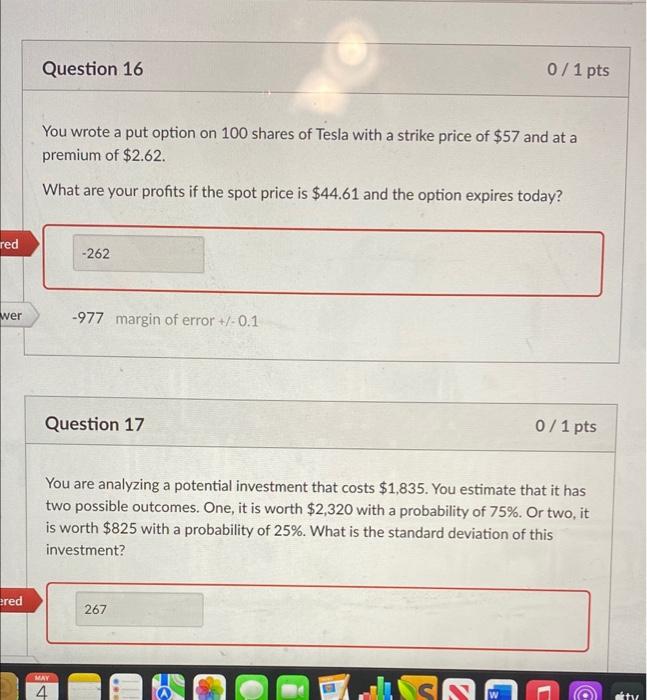

Question 16 0/1 pts You wrote a put option on 100 shares of Tesla with a strike price of $57 and at a premium of $2.62. What are your profits if the spot price is $44.61 and the option expires today? red -262 wer -977 margin of error +/-0.1 Question 17 0/1 pts You are analyzing a potential investment that costs $1,835. You estimate that it has two possible outcomes. One, it is worth $2,320 with a probability of 75%. Or two, it is worth $825 with a probability of 25%. What is the standard deviation of this investment? ered 267 MAY 4 s ty

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock