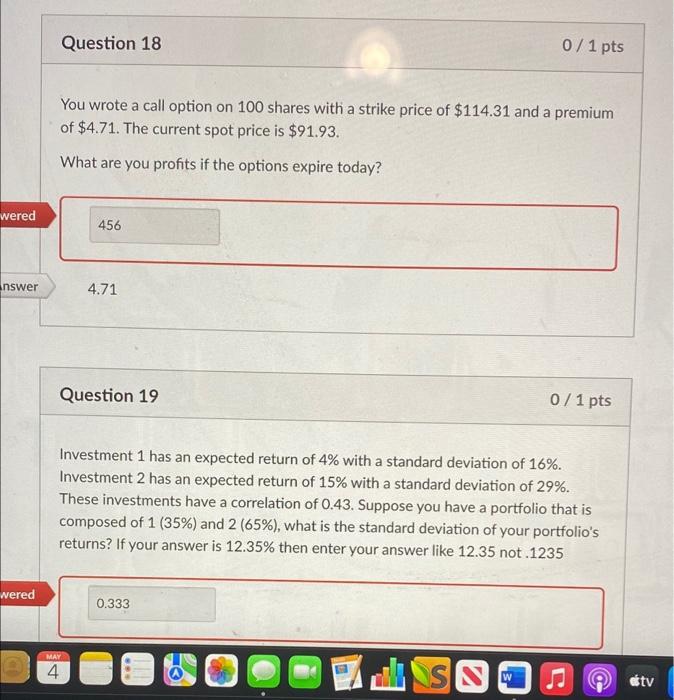

Question: Question 18 0 / 1 pts You wrote a call option on 100 shares with a strike price of $114.31 and a premium of $4.71.

Question 18 0 / 1 pts You wrote a call option on 100 shares with a strike price of $114.31 and a premium of $4.71. The current spot price is $91.93. What are you profits if the options expire today? wered 456 nswer 4.71 Question 19 0/1 pts Investment 1 has an expected return of 4% with a standard deviation of 16%. Investment 2 has an expected return of 15% with a standard deviation of 29%. These investments have a correlation of 0.43. Suppose you have a portfolio that is composed of 1 (35%) and 2 (65%), what is the standard deviation of your portfolio's returns? If your answer is 12.35% then enter your answer like 12.35 not.1235 wered 0.333 MAY 4. SS a tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts