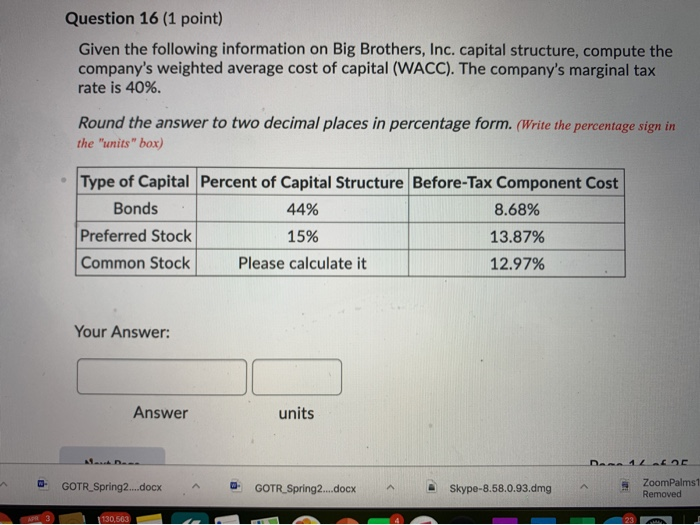

Question: Question 16 (1 point) Given the following information on Big Brothers, Inc. capital structure, compute the company's weighted average cost of capital (WACC). The company's

Question 16 (1 point) Given the following information on Big Brothers, Inc. capital structure, compute the company's weighted average cost of capital (WACC). The company's marginal tax rate is 40%. Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) Bonds Type of Capital Percent of Capital Structure Before-Tax Component Cost 44% 8.68% Preferred Stock 15% 13.87% Common Stock Please calculate it 12.97% Your Answer: Answer units GOTR_Spring2...docx G OTR_Spring2....docx ZoomPalms1 Removed 130,563

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock