Question: Question 16 1 points Save Ans Suppose that Comp. A and Comp. B, two hypothetical companies, are operating in a certain market and raised funds

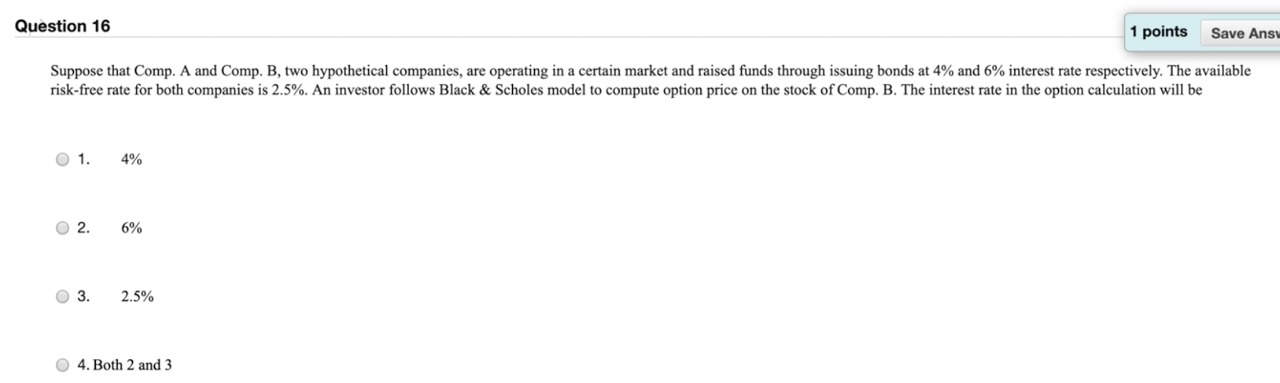

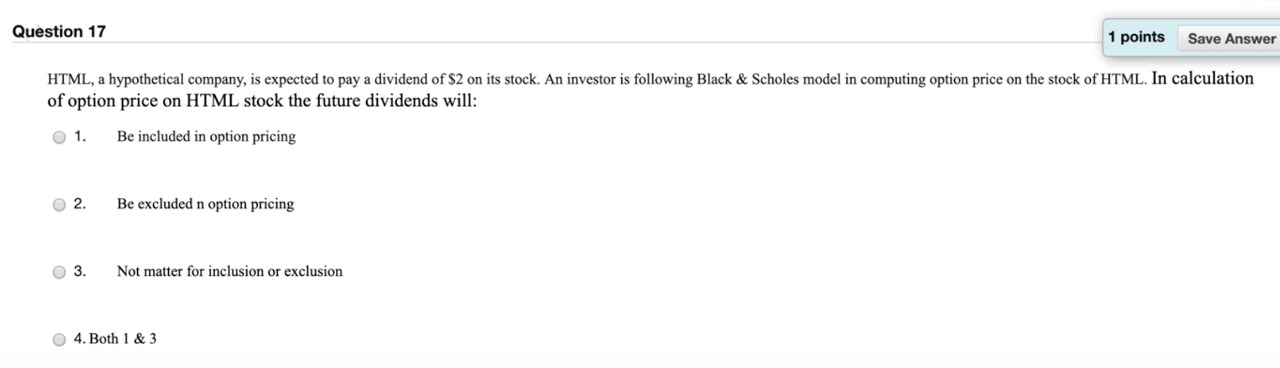

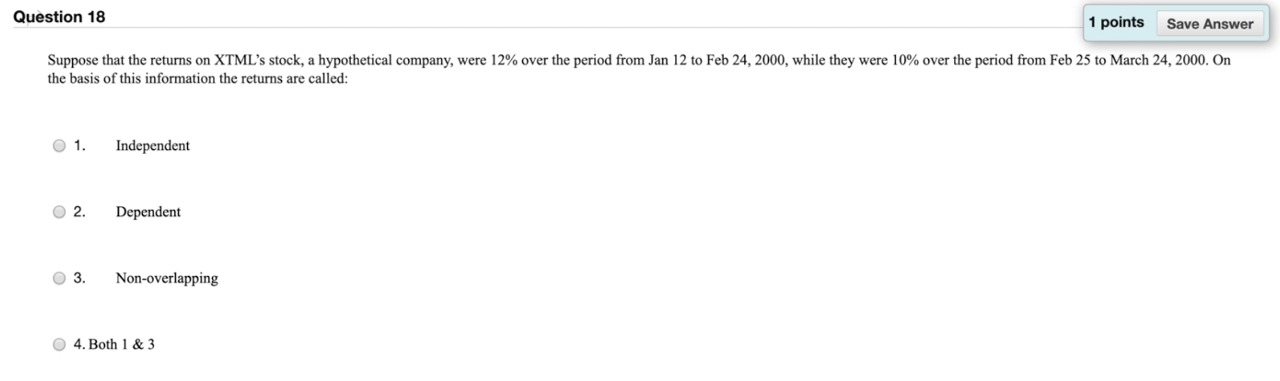

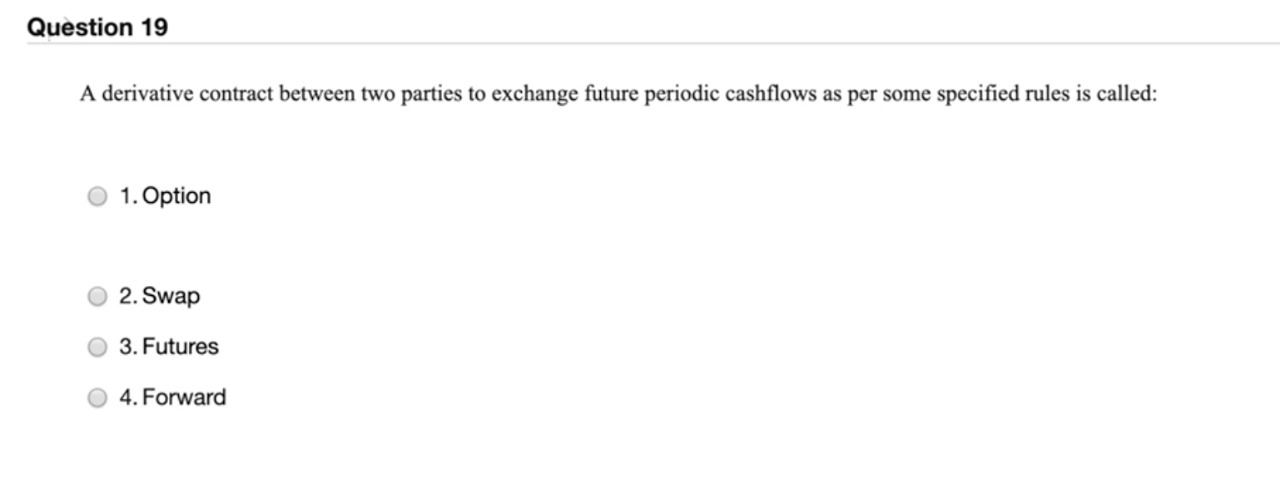

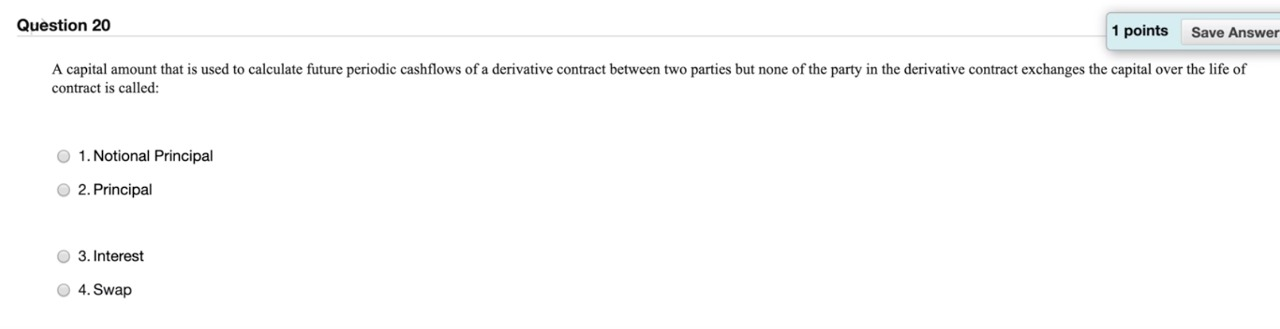

Question 16 1 points Save Ans Suppose that Comp. A and Comp. B, two hypothetical companies, are operating in a certain market and raised funds through issuing bonds at 4% and 6% interest rate respectively. The available risk-free rate for both companies is 2.5%. An investor follows Black & Scholes model to compute option price on the stock of Comp. B. The interest rate in the option calculation will be O 1. 4% 2. 6% O 3. 2.5% 4. Both 2 and 3 Question 17 1 points Save Answer HTML, a hypothetical company, is expected to pay a dividend of $2 on its stock. An investor is following Black & Scholes model in computing option price on the stock of HTML. In calculation of option price on HTML stock the future dividends will: O 1. Be included in option pricing 02. Be excluded n option pricing O 3. Not matter for inclusion or exclusion 04. Both 1 & 3 Question 18 1 points Save Answer Suppose that the returns on XTML's stock, a hypothetical company, were 12% over the period from Jan 12 to Feb 24, 2000, while they were 10% over the period from Feb 25 to March 24, 2000. On the basis of this information the returns are called: O 1. Independent O 2. Dependent O 3 Non-overlapping 4. Both 1 & 3 Question 19 A derivative contract between two parties to exchange future periodic cashflows as per some specified rules is called: 1. Option 2. Swap 3. Futures 4. Forward Question 20 1 points Save Answer A capital amount that is used to calculate future periodic cashflows of a derivative contract between two parties but none of the party in the derivative contract exchanges the capital over the life of contract is called: O 1. Notional Principal 2. Principal O 3. Interest 4. Swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts