Question: QUESTION 16 16. A stock's beta measures the: A) average return on the stock. B) volatility of the stock's returns relative to those of the

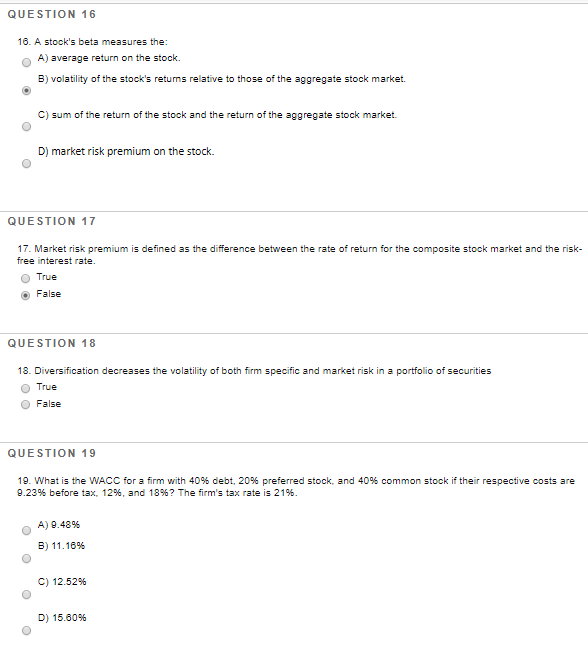

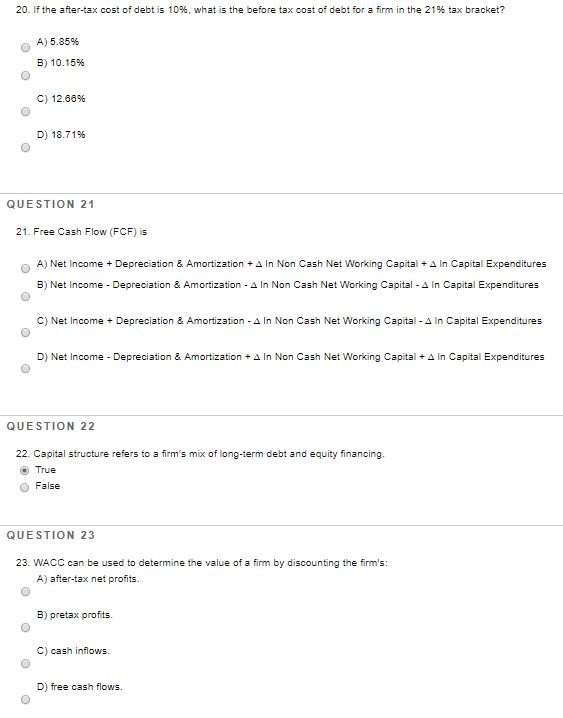

QUESTION 16 16. A stock's beta measures the: A) average return on the stock. B) volatility of the stock's returns relative to those of the aggregate stock market. c) sum of the return of the stock and the return of the aggregate stock market. D) market risk premium on the stock. QUESTION 17 17. Market risk premium is defined as the difference between the rate of return for the composite stock market and the risk- free interest rate. True False QUESTION 18 18. Diversification decreases the volatility of both firm specific and market risk in a portfolio of securities True O False QUESTION 19 10. What is the WACC for a firm with 40% debt, 20% preferred stock, and 40% common stock if their respective costs are 9.23% before tax, 12%, and 1896? The firm's tax rate is 21%. OA) 9.4896 B) 11.18% C) 12.52% D) 15.8096 20. If the after-tax cost of debt is 10%, what is the before tax cost of debt for a firm in the 21% tax bracket? A) 5.8596 B) 10.15% C) 12.66% D) 18.719 QUESTION 21 21. Free Cash Flow (FCF) is A) Net Income + Depreciation & Amortization + A In Non Cash Net Working Capital + A In Capital Expenditures B) Net Income - Depreciation & Amortization - A In Non Cash Net Working Capital - A In Capital Expenditures C) Net Income + Depreciation & Amortization - A In Non Cash Net Working Capital - A in Capital Expenditures D) Net Income - Depreciation & Amortization + A In Non Cash Net Working Capital + A In Capital Expenditures QUESTION 22 22. Capital structure refers to a firm's mix of long-term debt and equity financing True False QUESTION 23 23. WACC can be used to determine the value of a firm by discounting the firm's: A) after-tax net profits. 0 B) pretax profits. 0 C) cash inflows. 0 D) free cash flows. 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts