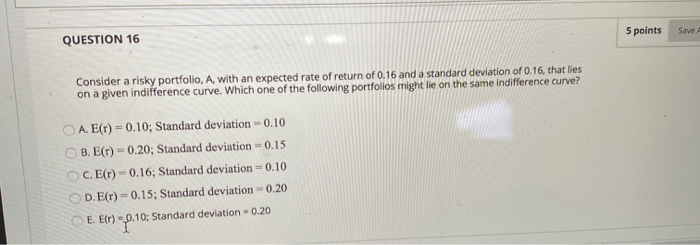

Question: QUESTION 16 5 points Save Consider a risky portfolio, A, with an expected rate of return of 0.16 and a standard deviation of 0.16, that

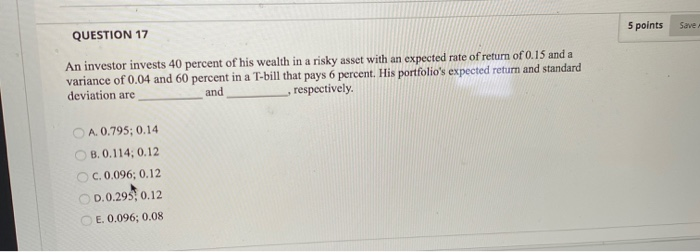

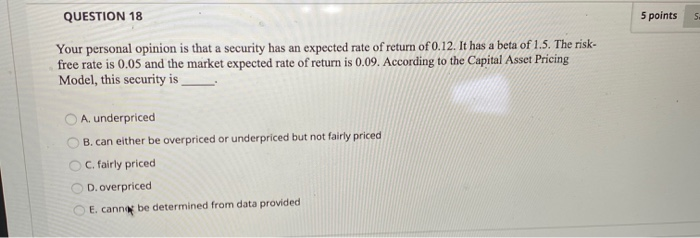

QUESTION 16 5 points Save Consider a risky portfolio, A, with an expected rate of return of 0.16 and a standard deviation of 0.16, that lies on a given indifference curve. Which one of the following portfolios might lie on the same indifference curve? O A E(T) = 0.10; Standard deviation - 0.10 B. E() - 0.20; Standard deviation - 0.15 C.E(r) -0.16; Standard deviation - 0.10 DE() -0.15; Standard deviation - 0.20 E. Er) = 0.10; Standard deviation - 0.20 QUESTION 17 5 points Save An investor invests 40 percent of his wealth in a risky asset with an expected rate of return of 0.15 and a variance of 0.04 and 60 percent in a T-bill that pays 6 percent. His portfolio's expected return and standard deviation are and _, respectively. A. 0.795; 0.14 OB. 0.114, 0.12 C.0.096; 0.12 0.0.295, 0.12 E. 0.096; 0.08 QUESTION 18 5 points S Your personal opinion is that a security has an expected rate of return of 0.12. It has a beta of 1.5. The risk- free rate is 0.05 and the market expected rate of return is 0.09. According to the Capital Asset Pricing Model, this security is A. underpriced B. can either be overpriced or underpriced but not fairly priced C. fairly priced D.overpriced E. cannot be determined from data provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts