Question: QUESTION 4 Consider a risky portfolio, A, with an expected rate of return of 0.20 and a standard deviation of 0.30, that lies on a

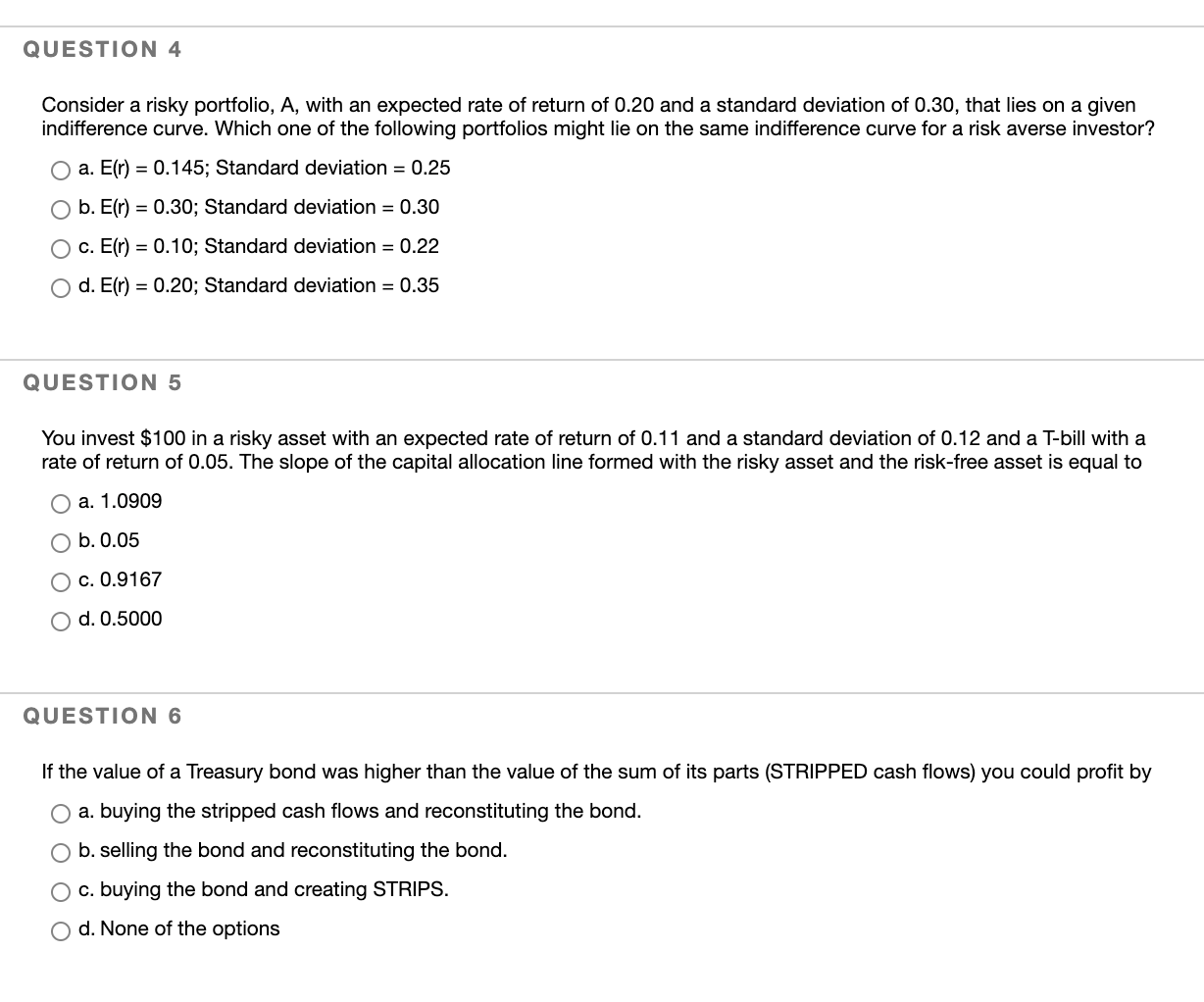

QUESTION 4 Consider a risky portfolio, A, with an expected rate of return of 0.20 and a standard deviation of 0.30, that lies on a given indifference curve. Which one of the following portfolios might lie on the same indifference curve for a risk averse investor? a. E(r) = 0.145; Standard deviation = 0.25 O b. E(r) = 0.30; Standard deviation = 0.30 O c. E(r) = 0.10; Standard deviation = 0.22 O d. E(r) = 0.20; Standard deviation = 0.35 QUESTION 5 You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.12 and a T-bill with a rate of return of 0.05. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to O a. 1.0909 O b. 0.05 O c. 0.9167 O d. 0.5000 QUESTION 6 If the value of a Treasury bond was higher than the value of the sum of its parts (STRIPPED cash flows) you could profit by a. buying the stripped cash flows and reconstituting the bond. O b. selling the bond and reconstituting the bond. O c. buying the bond and creating STRIPS. O d. None of the options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts