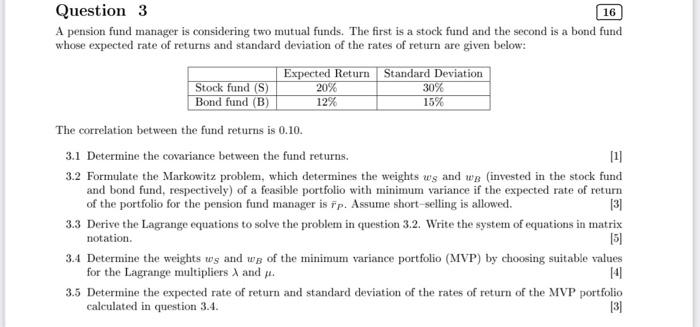

Question: Question 16 A pension fund manager is considering two mutual funds. The first is a stock fund and the second is a bond fund whose

Question 16 A pension fund manager is considering two mutual funds. The first is a stock fund and the second is a bond fund whose expected rate of returns and standard deviation of the rates of return are given below: The correlation between the fund returns is 0.10 . 3.1 Determine the covariance between the fund returns. [1] 3.2 Formulate the Markowitz problem, which determines the weights wS and wB (invested in the stock fund and bond fund, respectively) of a feasible portfolio with minimum variance if the expected rate of return of the portfolio for the pension fund manager is r~P. Assume short-selling is allowed. [3] 3.3 Derive the Lagrange equations to solve the problem in question 3.2. Write the system of equations in matrix notation. [5] 3.4 Determine the weights wS and wB of the minimum variance portfolio (MVP) by choosing suitable values for the Lagrange multipliers and . [4] 3.5 Determine the expected rate of return and standard deviation of the rates of return of the MVP portfolio calculated in question 3.4. [3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts