Question: Question 16 Consider the following data for XMart Inc. Net income - 4000, Capital expenditure = 800, depreciation = 360, last year WC = 1600.

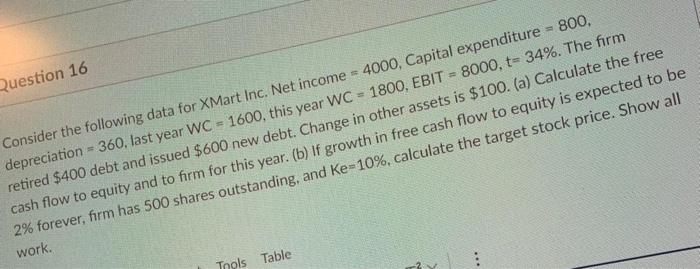

Question 16 Consider the following data for XMart Inc. Net income - 4000, Capital expenditure = 800, depreciation = 360, last year WC = 1600. this year WC - 1800, EBIT - 8000, t= 34%. The firm retired $400 debt and issued $600 new debt. Change in other assets is $100. (a) Calculate the free cash flow to equity and to form for this year. (b) If growth in free cash flow to equity is expected to be 2% forever, firm has 500 shares outstanding, and Ke=10%, calculate the target stock price. Show all work. Tools Table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock