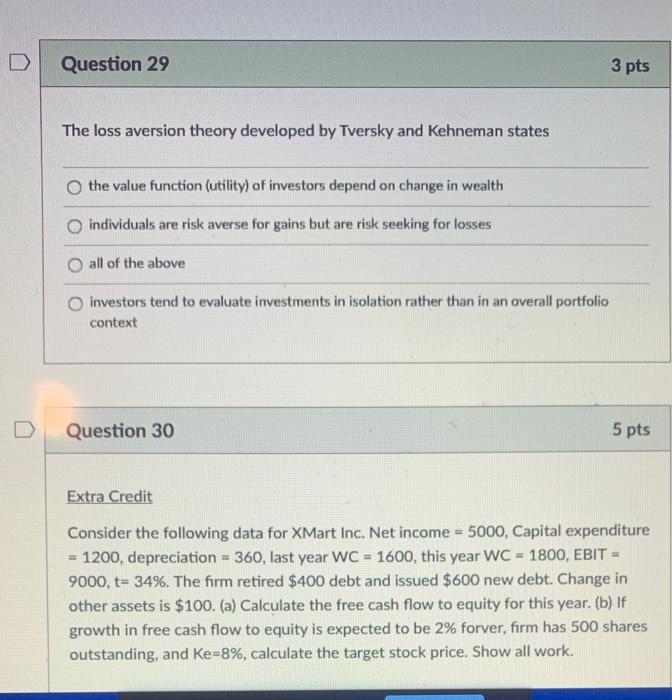

Question: Question 29 3 pts The loss aversion theory developed by Tversky and Kehneman states the value function (utility) of investors depend on change in wealth

Question 29 3 pts The loss aversion theory developed by Tversky and Kehneman states the value function (utility) of investors depend on change in wealth individuals are risk averse for gains but are risk seeking for losses all of the above o investors tend to evaluate investments in isolation rather than in an overall portfolio context Question 30 5 pts Extra Credit Consider the following data for XMart Inc. Net income = 5000, Capital expenditure 1200, depreciation = 360, last year WC = 1600, this year WC - 1800, EBIT = 9000, t= 34%. The firm retired $400 debt and issued $600 new debt. Change in other assets is $100. (a) Calculate the free cash flow to equity for this year. (b) If growth in free cash flow to equity is expected to be 2% forver, firm has 500 shares outstanding, and Ke=8%, calculate the target stock price. Show all work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts