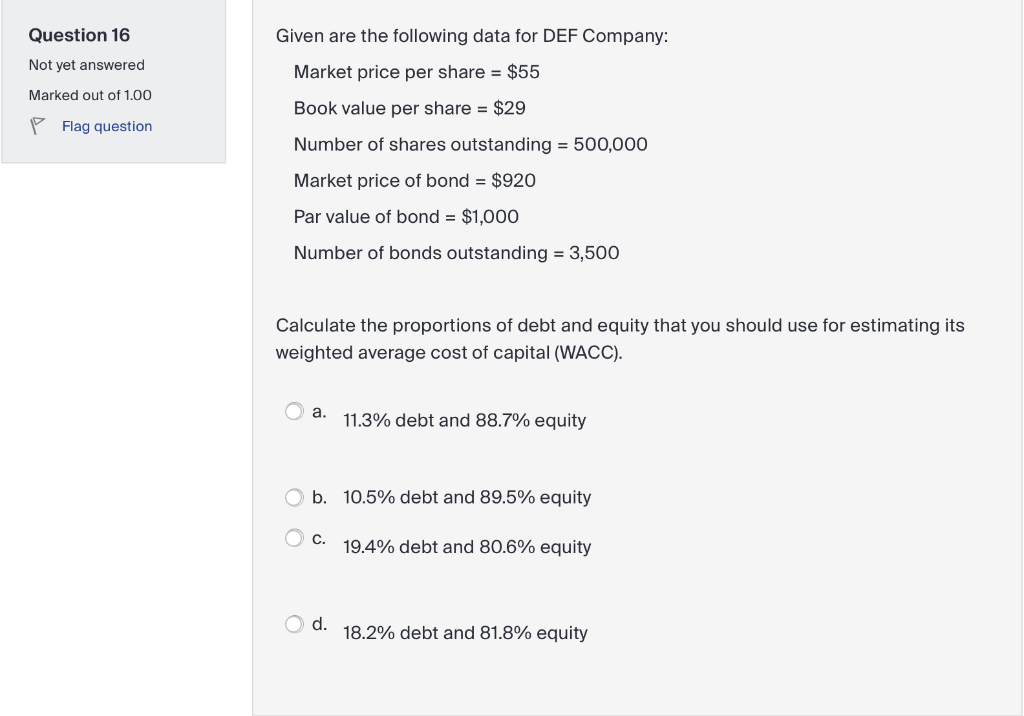

Question: Question 16 Given are the following data for DEF Company: Market price per share = $55 Not yet answered Marked out of 1.00 Flag question

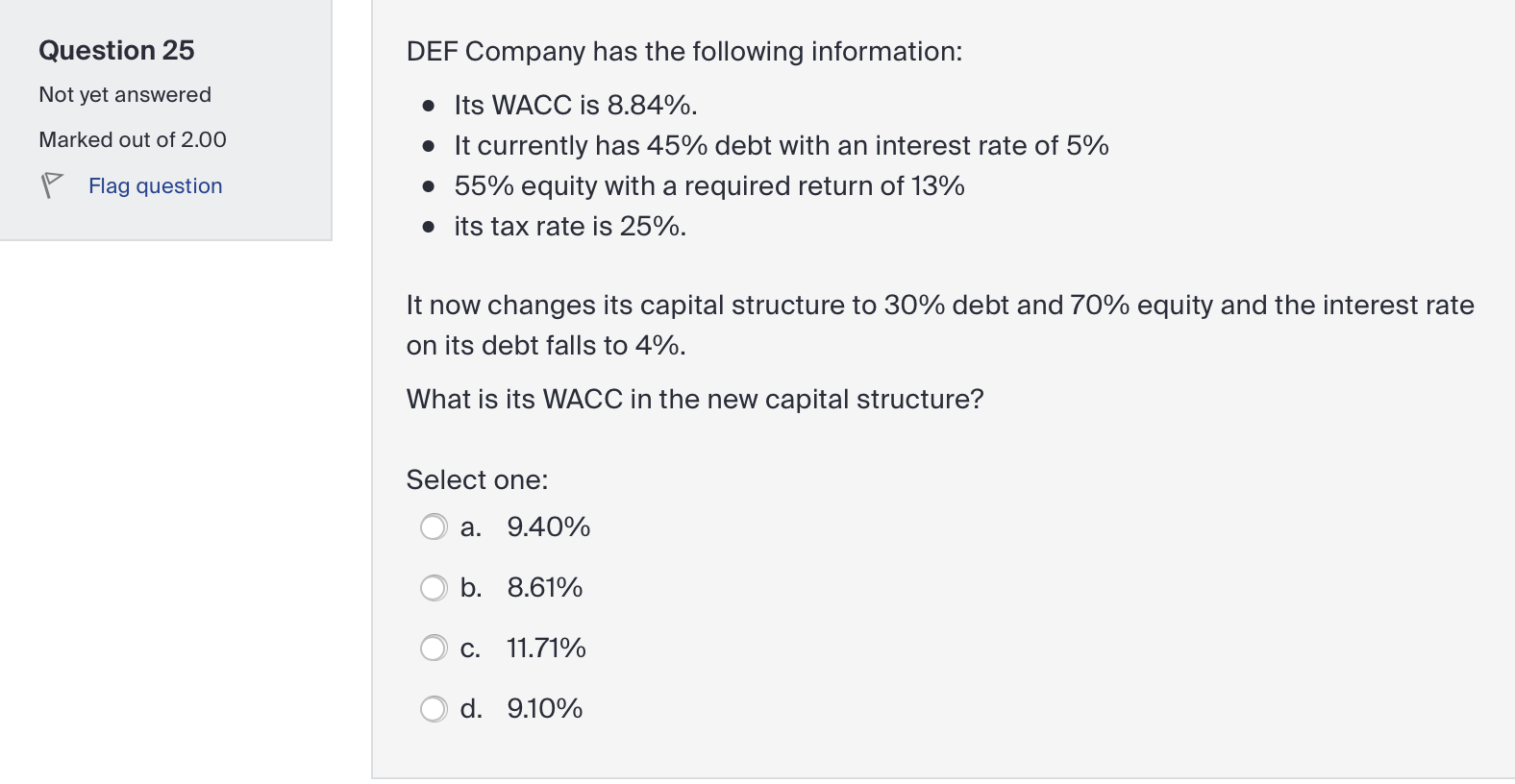

Question 16 Given are the following data for DEF Company: Market price per share = $55 Not yet answered Marked out of 1.00 Flag question Book value per share = $29 Number of shares outstanding = 500,000 Market price of bond = $920 Par value of bond = $1,000 Number of bonds outstanding = 3,500 Calculate the proportions of debt and equity that you should use for estimating its weighted average cost of capital (WACC). O a. 11.3% debt and 88.7% equity Ob. 10.5% debt and 89.5% equity O c. 19.4% debt and 80.6% equity O d. 18.2% debt and 81.8% equity Question 25 DEF Company has the following information: Not yet answered Marked out of 2.00 Its WACC is 8.84%. It currently has 45% debt with an interest rate of 5% 55% equity with a required return of 13% its tax rate is 25%. P Flag question It now changes its capital structure to 30% debt and 70% equity and the interest rate on its debt falls to 4%. What is its WACC in the new capital structure? Select one: a. 9.40% b. 8.61% c. 11.71% d. 9.10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts