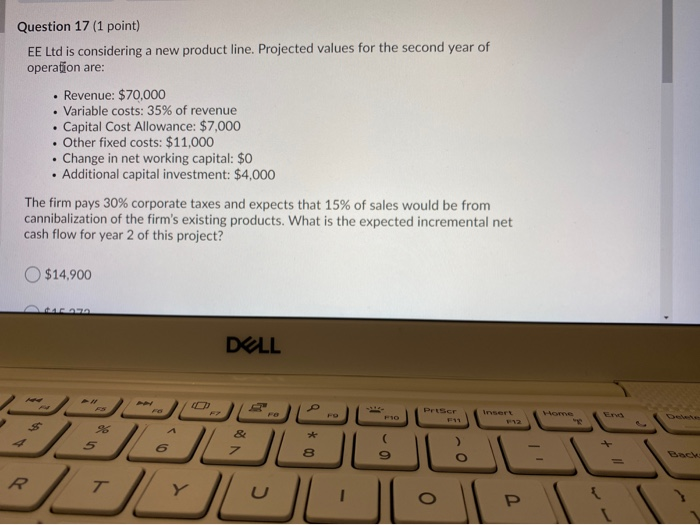

Question: Question 17 (1 point) EE Ltd is considering a new product line. Projected values for the second year of operation are: . Revenue: $70,000 .

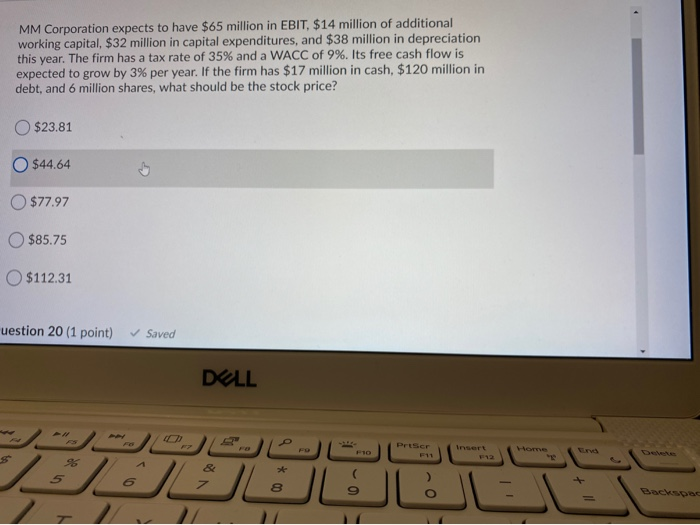

Question 17 (1 point) EE Ltd is considering a new product line. Projected values for the second year of operation are: . Revenue: $70,000 . Variable costs: 35% of revenue Capital Cost Allowance: $7,000 Other fixed costs: $11,000 Change in net working capital: $0 Additional capital investment: $4,000 The firm pays 30% corporate taxes and expects that 15% of sales would be from cannibalization of the firm's existing products. What is the expected incremental net cash flow for year 2 of this project? O $14,900 2 DELL : " -= = Back MM Corporation expects to have $65 million in EBIT, $14 million of additional working capital, $32 million in capital expenditures, and $38 million in depreciation this year. The firm has a tax rate of 35% and a WACC of 9%. Its free cash flow is expected to grow by 3% per year. If the firm has $17 million in cash, $120 million in debt, and 6 million shares, what should be the stock price? O $23.81 O $44.64 O$7797 O $85.75 | O $112.31 uestion 20 (1 point) Saved DELL -

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts