Question: EE Ltd is considering a new product line. Projected values for the second year of operation are: Revenue: $60,000 . Variable costs: 30% of revenue

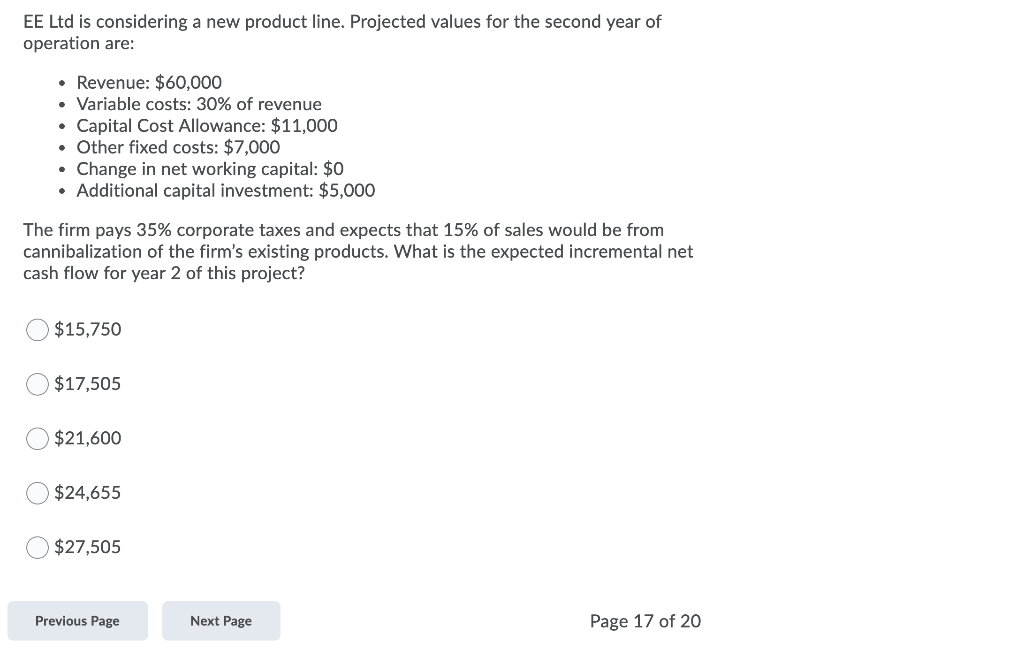

EE Ltd is considering a new product line. Projected values for the second year of operation are: Revenue: $60,000 . Variable costs: 30% of revenue Capital Cost Allowance: $11,000 Other fixed costs: $7,000 Change in net working capital: $0 Additional capital investment: $5,000 The firm pays 35% corporate taxes and expects that 15% of sales would be from cannibalization of the firm's existing products. What is the expected incremental net cash flow for year 2 of this project? $15,750 $17,505 $21,600 $24,655 $27,505 Previous Page Next Page Page 17 of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts