Question: Question 17 1 pts A $89,000 machine with a 10-year class life was purchased 2 years ago. The machine will now be sold for $32,000

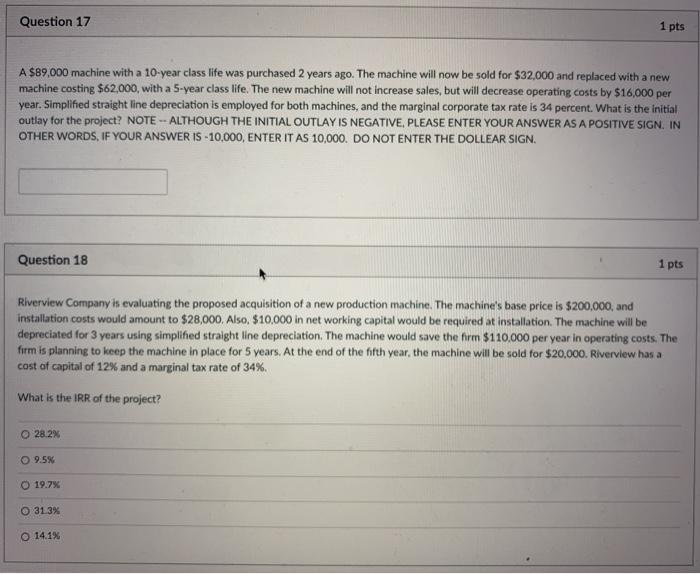

Question 17 1 pts A $89,000 machine with a 10-year class life was purchased 2 years ago. The machine will now be sold for $32,000 and replaced with a new machine costing $62,000, with a 5-year class life. The new machine will not increase sales, but will decrease operating costs by $16,000 per year. Simplified straight line depreciation is employed for both machines, and the marginal corporate tax rate is 34 percent. What is the initial outlay for the project? NOTE - ALTHOUGH THE INITIAL OUTLAY IS NEGATIVE. PLEASE ENTER YOUR ANSWER AS A POSITIVE SIGN IN OTHER WORDS, IF YOUR ANSWER IS - 10,000, ENTER IT AS 10,000. DO NOT ENTER THE DOLLEAR SIGN Question 18 1 pts Riverview Company is evaluating the proposed acquisition of a new production machine. The machine's base price is $200,000, and installation costs would amount to $28,000. Also, $10,000 in net working capital would be required at installation. The machine will be depreciated for 3 years using simplified straight line depreciation. The machine would save the firm $110,000 per year in operating costs. The firm is planning to keep the machine in place for 5 years. At the end of the fifth year, the machine will be sold for $20,000. Riverview has a cost of capital of 12% and a marginal tax rate of 34% What is the IRR of the project? 28.2% 9.5% 19.7% O 31.3% O 14.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts