Question: QUESTION 17 15 points Save Answer Founder owns 5,000,000 shares of common stock in Piper Corporation. Piper now needs to raise $3,000,000 to execute its

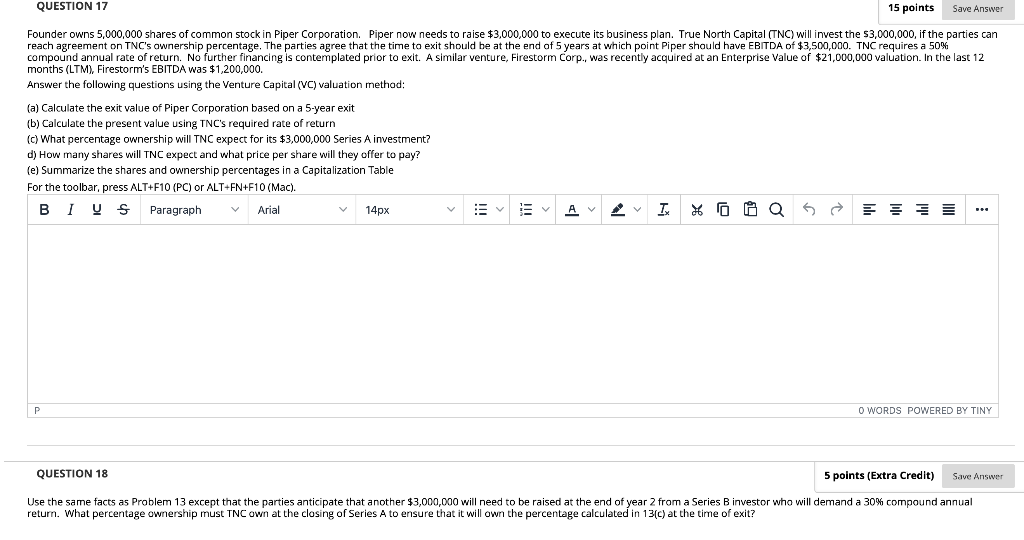

QUESTION 17 15 points Save Answer Founder owns 5,000,000 shares of common stock in Piper Corporation. Piper now needs to raise $3,000,000 to execute its business plan. True North Capital (TNC) will invest the $3,000,000, if the parties can reach agreement on TNC's ownership percentage. The parties agree that the time to exit should be at the end of 5 years at which point Piper should have EBITDA of $3,500,000. TNC requires a 50% compound annual rate of return. No further financing is contemplated prior to exit. A similar venture, Firestorm Corp., was recently acquired at an Enterprise Value of $21,000,000 valuation. In the last 12 months (LTM), Firestorm's EBITDA was $1,200,000. Answer the following questions using the Venture Capital (VC) valuation method: (a) Calculate the exit value of Piper Corporation based on a 5-year exit (b) Calculate the present value using TNC's required rate of return (c) What percentage ownership will TNC expect for its $3,000,000 Series A investment? d) How many shares will TNC expect and what price per share will they offer to pay? (e) Summarize the shares and ownership percentages in a Capitalization Table For the toolbar, press ALT+F10 (PC) or ALTEN+F10 (Mac). B 1 S Paragraph Arial 14px A v T O WORDS POWERED BY TINY QUESTION 18 5 points (Extra Credit) Save Answer Use the same facts as Problem 13 except that the parties anticipate that another $3,000,000 will need to be raised at the end of year 2 from a Series B investor who will demand a 30% compound annual return. What percentage ownership must TNC own at the closing of Series A to ensure that it will own the percentage calculated in 13(C) at the time of exit? QUESTION 17 15 points Save Answer Founder owns 5,000,000 shares of common stock in Piper Corporation. Piper now needs to raise $3,000,000 to execute its business plan. True North Capital (TNC) will invest the $3,000,000, if the parties can reach agreement on TNC's ownership percentage. The parties agree that the time to exit should be at the end of 5 years at which point Piper should have EBITDA of $3,500,000. TNC requires a 50% compound annual rate of return. No further financing is contemplated prior to exit. A similar venture, Firestorm Corp., was recently acquired at an Enterprise Value of $21,000,000 valuation. In the last 12 months (LTM), Firestorm's EBITDA was $1,200,000. Answer the following questions using the Venture Capital (VC) valuation method: (a) Calculate the exit value of Piper Corporation based on a 5-year exit (b) Calculate the present value using TNC's required rate of return (c) What percentage ownership will TNC expect for its $3,000,000 Series A investment? d) How many shares will TNC expect and what price per share will they offer to pay? (e) Summarize the shares and ownership percentages in a Capitalization Table For the toolbar, press ALT+F10 (PC) or ALTEN+F10 (Mac). B 1 S Paragraph Arial 14px A v T O WORDS POWERED BY TINY QUESTION 18 5 points (Extra Credit) Save Answer Use the same facts as Problem 13 except that the parties anticipate that another $3,000,000 will need to be raised at the end of year 2 from a Series B investor who will demand a 30% compound annual return. What percentage ownership must TNC own at the closing of Series A to ensure that it will own the percentage calculated in 13(C) at the time of exit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts