Question: Question 17 (2 points) ABC Co as lessee records a finance lease of machinery on January 1, 20xl. The seven annual lease payments of $200,000

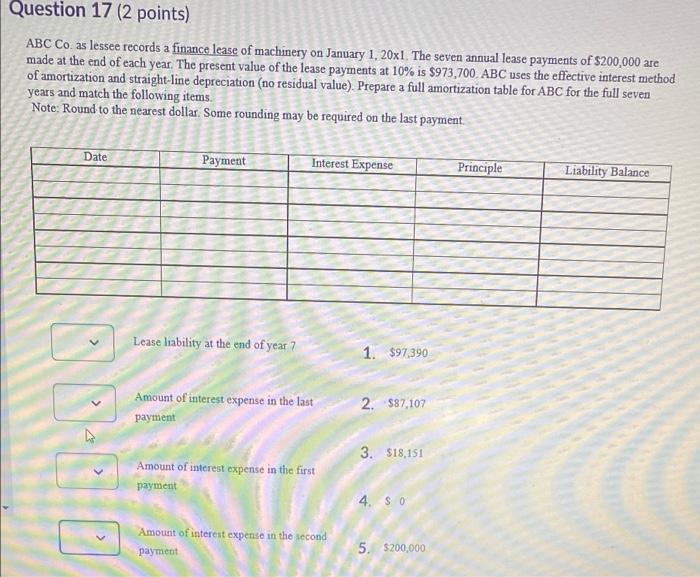

Question 17 (2 points) ABC Co as lessee records a finance lease of machinery on January 1, 20xl. The seven annual lease payments of $200,000 arc made at the end of each year. The present value of the lease payments at 10% is $973,700. ABC uses the effective interest method of amortization and straight-line depreciation (no residual value). Prepare a full amortization table for ABC for the full seven years and match the following items, Note: Round to the nearest dollar. Some rounding may be required on the last payment Date Payment Interest Expense Principle Liability Balance Lease liability at the end of year 7 1. $97,390 Amount of interest expense in the last payment 2. $87,109 4 3. $18.151

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts