Question: Question 17 (2 points) Saved 1) Listen When a partnership is liquidated: A) Noncash assets are converted to cash. B) Any gain or loss on

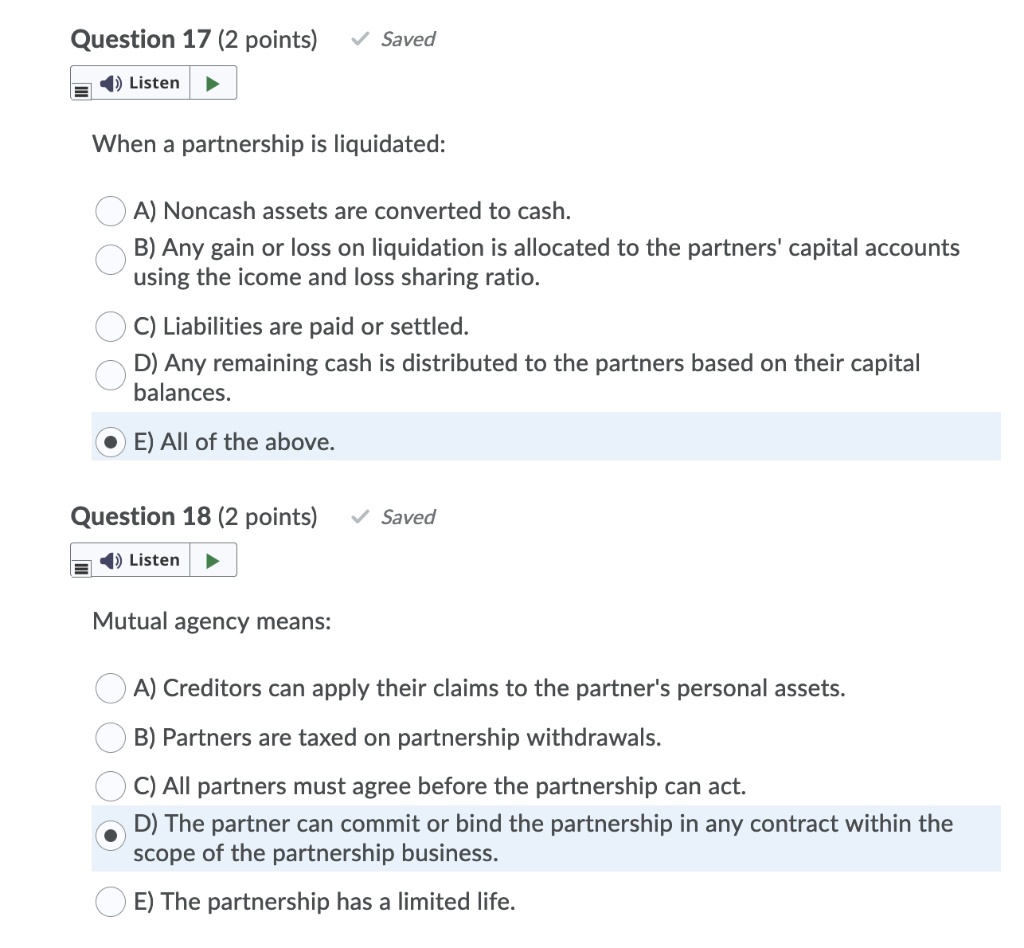

Question 17 (2 points) Saved 1) Listen When a partnership is liquidated: A) Noncash assets are converted to cash. B) Any gain or loss on liquidation is allocated to the partners' capital accounts using the icome and loss sharing ratio. C) Liabilities are paid or settled. D) Any remaining cash is distributed to the partners based on their capital balances. E) All of the above. Question 18 (2 points) Saved Listen Mutual agency means: A) Creditors can apply their claims to the partner's personal assets. B) Partners are taxed on partnership withdrawals. C) All partners must agree before the partnership can act. D) The partner can commit or bind the partnership in any contract within the scope of the partnership business. E) The partnership has a limited life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts