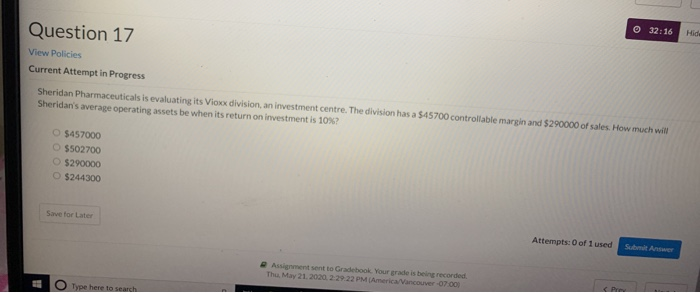

Question: Question 17 32:16 Hid View Policies Current Attempt in Progress Sheridan Pharmaceuticals is evaluating its Vioxx division, an investment centre. The division has a $45700

Question 17 32:16 Hid View Policies Current Attempt in Progress Sheridan Pharmaceuticals is evaluating its Vioxx division, an investment centre. The division has a $45700 controllable margin and $290000 of sales. How much will Sheridan's average operating assets be when its return on investment is 10%? $457000 $502700 $290000 $244300 Save for Later Attempts: 0 of 1 used Submit A Assignment sent to Gradebook Your grade is being recorded Thu, May 21, 2020. 229 22 PM America/Vancouver -07001 Type here to search Question 17 32:16 Hid View Policies Current Attempt in Progress Sheridan Pharmaceuticals is evaluating its Vioxx division, an investment centre. The division has a $45700 controllable margin and $290000 of sales. How much will Sheridan's average operating assets be when its return on investment is 10%? $457000 $502700 $290000 $244300 Save for Later Attempts: 0 of 1 used Submit A Assignment sent to Gradebook Your grade is being recorded Thu, May 21, 2020. 229 22 PM America/Vancouver -07001 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts