Question: Question 17 (4 points) Brightspace Co. is considering a 4-year project. The project is estimated to result in $299.193 in annual pretax revenue increases and

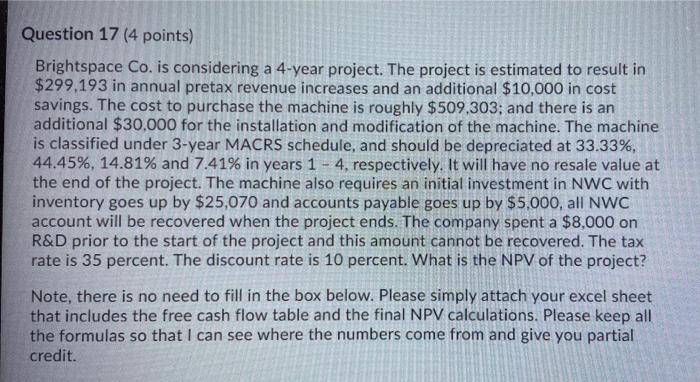

Question 17 (4 points) Brightspace Co. is considering a 4-year project. The project is estimated to result in $299.193 in annual pretax revenue increases and an additional $10,000 in cost savings. The cost to purchase the machine is roughly $509,303; and there is an additional $30,000 for the installation and modification of the machine. The machine is classified under 3-year MACRS schedule, and should be depreciated at 33.33%, 44.45%, 14.81% and 7.41% in years 1 - 4, respectively. It will have no resale value at the end of the project. The machine also requires an initial investment in NWC with inventory goes up by $25,070 and accounts payable goes up by $5,000, all NWC account will be recovered when the project ends. The company spent a $8,000 on R&D prior to the start of the project and this amount cannot be recovered. The tax rate is 35 percent. The discount rate is 10 percent. What is the NPV of the project? Note, there is no need to fill in the box below. Please simply attach your excel sheet that includes the free cash flow table and the final NPV calculations. Please keep all the formulas so that I can see where the numbers come from and give you partial credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts