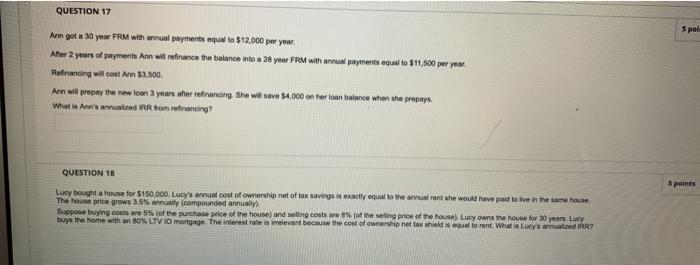

Question: QUESTION 17 5 per Arn got a 30 your FRM with annual payments equal to $12,000 per year After 2 years of payments Ann will

QUESTION 17 5 per Arn got a 30 your FRM with annual payments equal to $12,000 per year After 2 years of payments Ann will refinance the balance into a 28 year FRM with annual payments equal to $11,500 per year. Refinancing will cost A $3.500 Are will prepay the new loan 3 years after refinancing. She will save $4,000 on her loan balance when the prepays. What is Ann's arrunted IRR from refinancing QUESTION 18 5 points Lucy bought a house for $150,000. Lucy's anual cost of ownership net of tax savings is exactly equal to the aut rent she would have paid to live in the same house The house price grows 35% annually compounded annually). Suppose buying costs 5% of the purchase price of the house and selling costs are 8% of the ling price of the house Lucy owns the house for 30 years. Lucy buys the home with an 80% LTVO mortgage. The interest rate is relevant because the cost of ownership net tax whild to rent. What is Lucy'IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts