Question: SECTION D-40 marks Instructions: This section consists of two (2) computational problems with marks as indicated. Answer both questions in the answer booklet provided, showing

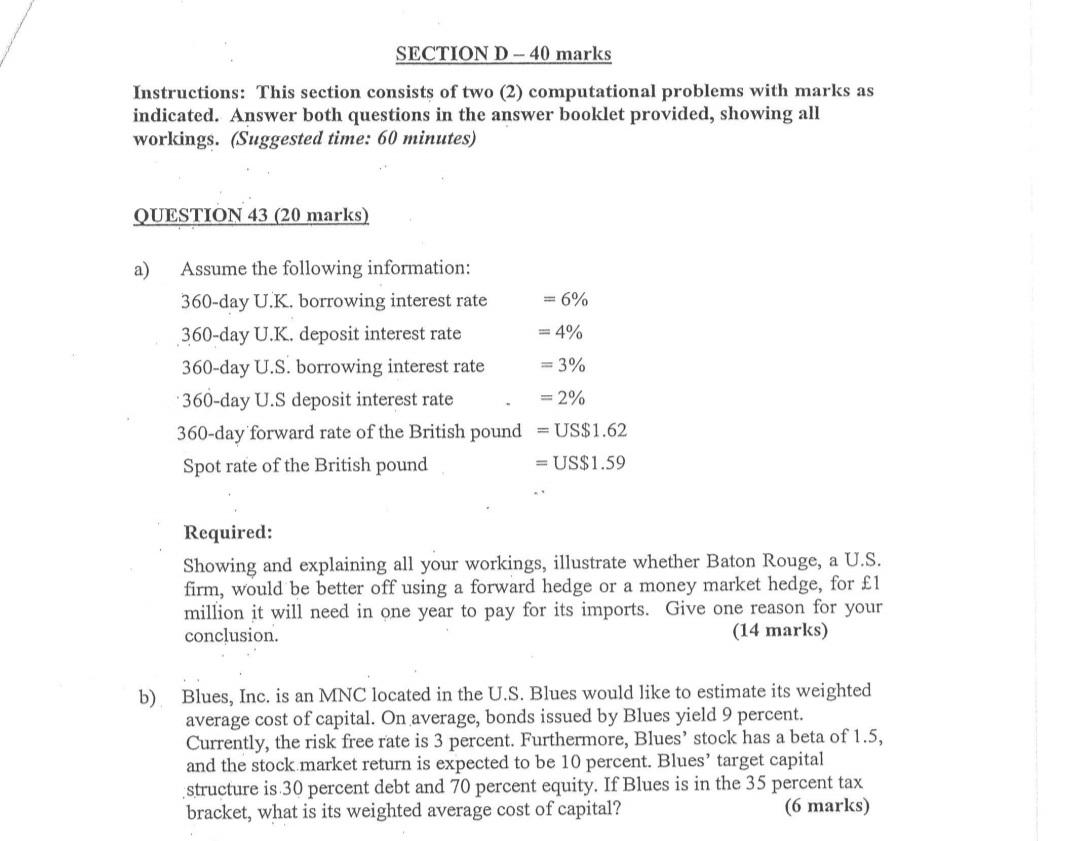

SECTION D-40 marks Instructions: This section consists of two (2) computational problems with marks as indicated. Answer both questions in the answer booklet provided, showing all workings. (Suggested time: 60 minutes) QUESTION 43 (20 marks) a) Assume the following information: 360-day U.K. borrowing interest rate = 6% 360-day U.K. deposit interest rate = 4% 360-day U.S. borrowing interest rate = 3% 360-day U.S deposit interest rate = 2% 360-day forward rate of the British pound = US$1.62 Spot rate of the British pound = US$1.59 Required: Showing and explaining all your workings, illustrate whether Baton Rouge, a U.S. firm, would be better off using a forward hedge or a money market hedge, for 1 million it will need in one year to pay for its imports. Give one reason for your conclusion. (14 marks) b) Blues, Inc. is an MNC located in the U.S. Blues would like to estimate its weighted average cost of capital. On average, bonds issued by Blues yield 9 percent. Currently, the risk free rate is 3 percent. Furthermore, Blues' stock has a beta of 1.5, and the stock market return is expected to be 10 percent. Blues' target capital structure is 30 percent debt and 70 percent equity. If Blues is in the 35 percent tax bracket, what is its weighted average cost of capital? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts