Question: Question 17 (5 points) You want to evaluate a start-up company. Blenders is planning to open its blended juice shop in Los Angeles area soon,

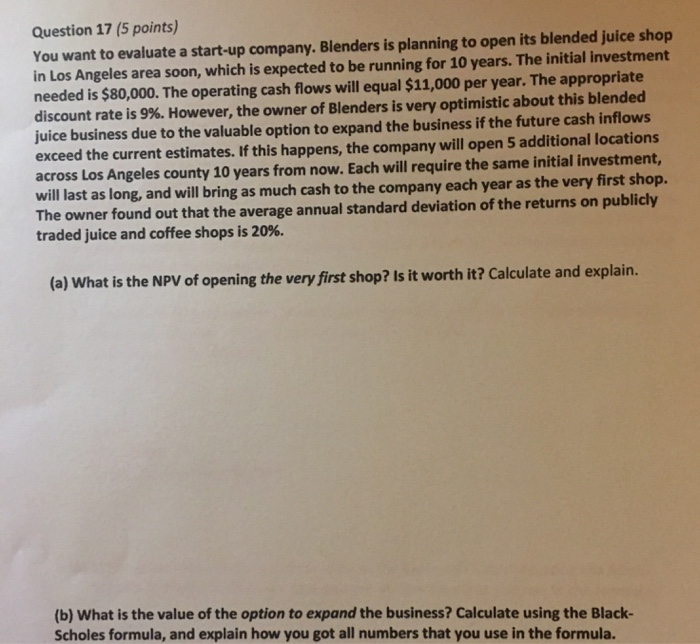

Question 17 (5 points) You want to evaluate a start-up company. Blenders is planning to open its blended juice shop in Los Angeles area soon, which is expected to be running for 10 years. The initial investment needed is $80,000. The operating cash flows will equal $11,000 per year. The appropriate discount rate is 9%. However, the owner of Blenders is very optimistic about this blended juice business due to the valuable option to expand the business if the future cash inflows exceed the current estimates. If this happens, the company will open 5 additional locations across Los Angeles county 10 years from now. Each will require the same initial investment, will last as long, and will bring as much cash to the company each year as the very first shop. The owner found out that the average annual standard deviation of the returns on publicly traded juice and coffee shops is 20%. (a) What is the NPV of opening the very first shop? Is it worth it? Calculate and explain. (b) What is the value of the option to expand the business? Calculate using the Black- Scholes formula, and explain how you got all numbers that you use in the formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts