Question: QUESTION 17 Use the data below for questions 16 and 17 ============================================================================ Assume that security returns are generated by the single index model Ri= dj

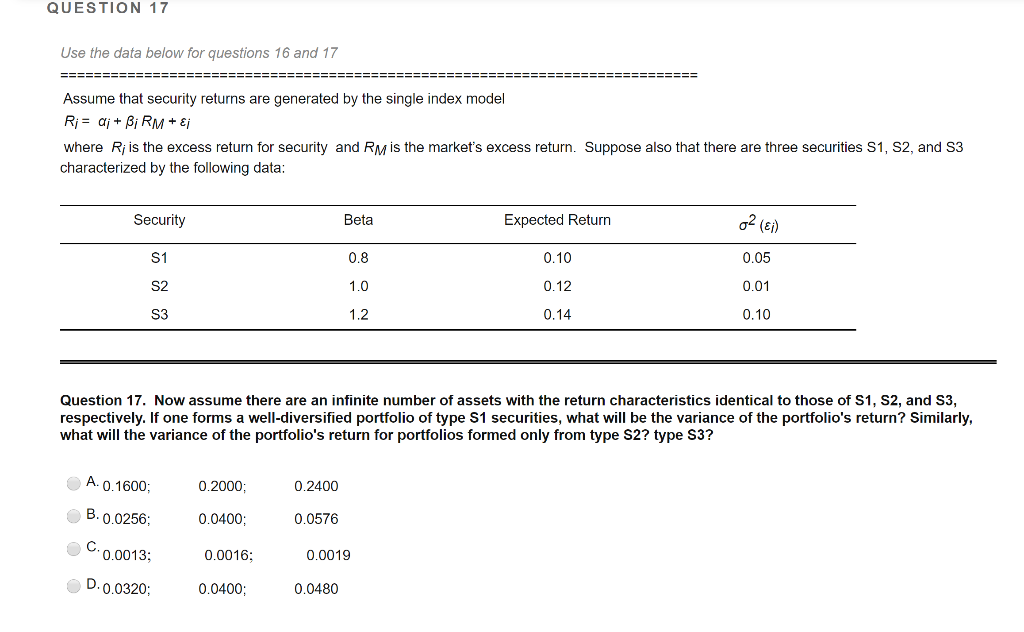

QUESTION 17 Use the data below for questions 16 and 17 ============================================================================ Assume that security returns are generated by the single index model Ri= dj + Bi RM + Ej where Ri is the excess return for security and RM is the market's excess return. Suppose also that there are three securities S1, S2, and S3 characterized by the following data: Security Beta Expected Return S1 0.8 1.0 0.10 0.12 0.14 02 (81) 0.05 0.01 0.10 1.2 Question 17. Now assume there are an infinite number of assets with the return characteristics identical to those of S1, S2, and S3, respectively. If one forms a well-diversified portfolio of type S1 securities, what will be the variance of the portfolio's return? Similarly, what will the variance of the portfolio's return for portfolios formed only from type S2? type S3? 0.2400 0.2000; 0.0400; 0.0576 A. 0.1600; B. 0.0256 C.0.0013; D.0.0320 0.0016; 0.0019 0.0400; 0.0480 QUESTION 17 Use the data below for questions 16 and 17 ============================================================================ Assume that security returns are generated by the single index model Ri= dj + Bi RM + Ej where Ri is the excess return for security and RM is the market's excess return. Suppose also that there are three securities S1, S2, and S3 characterized by the following data: Security Beta Expected Return S1 0.8 1.0 0.10 0.12 0.14 02 (81) 0.05 0.01 0.10 1.2 Question 17. Now assume there are an infinite number of assets with the return characteristics identical to those of S1, S2, and S3, respectively. If one forms a well-diversified portfolio of type S1 securities, what will be the variance of the portfolio's return? Similarly, what will the variance of the portfolio's return for portfolios formed only from type S2? type S3? 0.2400 0.2000; 0.0400; 0.0576 A. 0.1600; B. 0.0256 C.0.0013; D.0.0320 0.0016; 0.0019 0.0400; 0.0480

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts