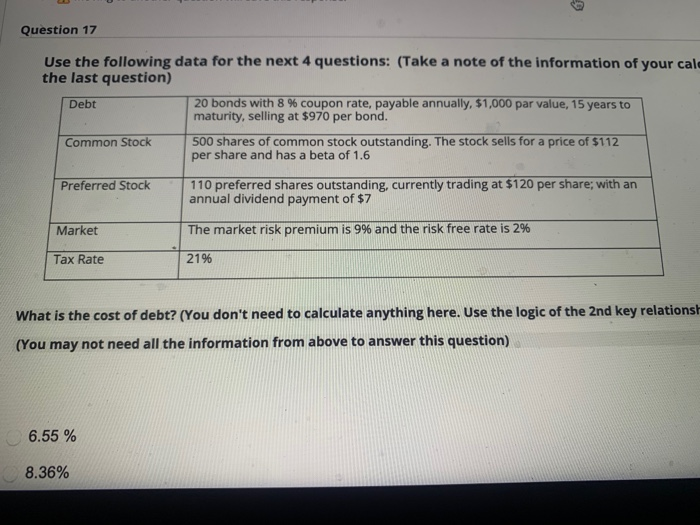

Question: Question 17 Use the following data for the next 4 questions: (Take a note of the information of your cale the last question) Debt 20

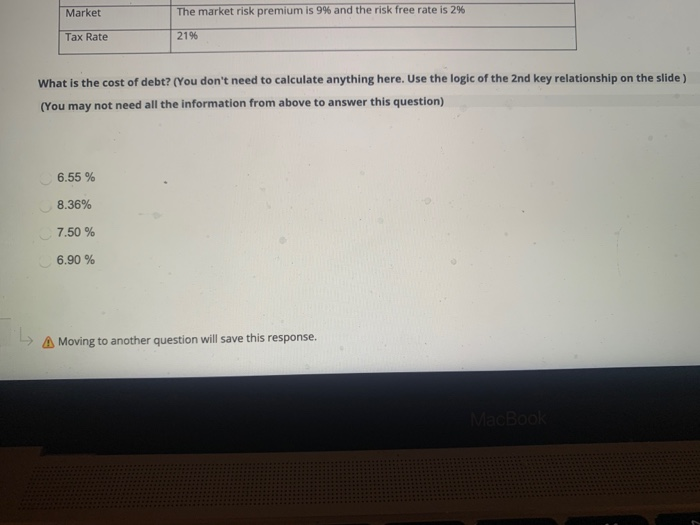

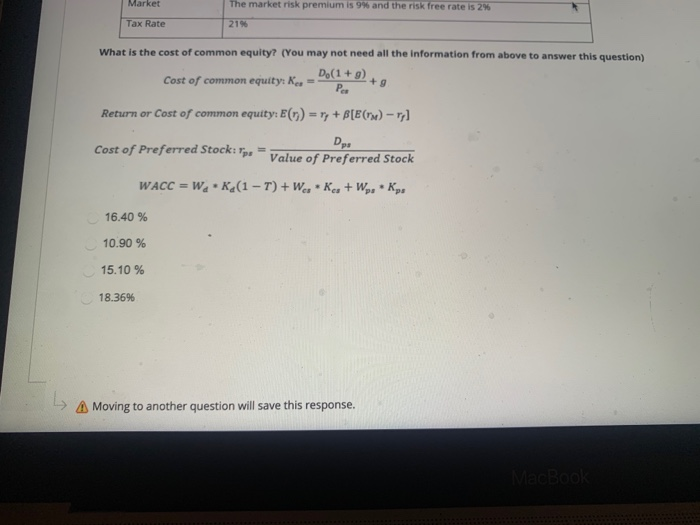

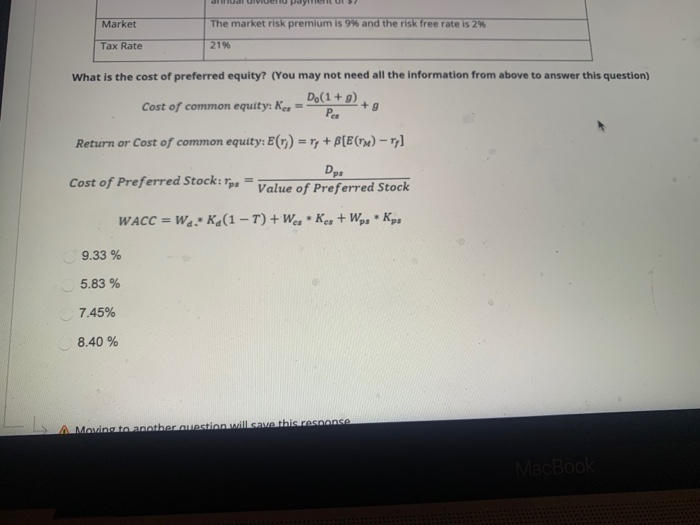

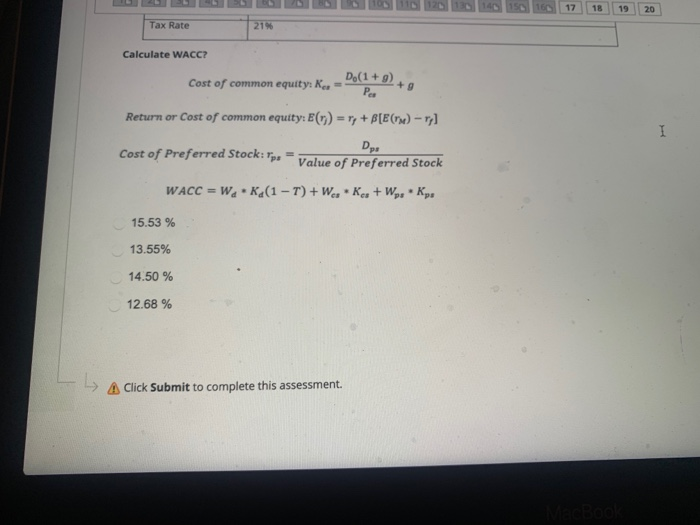

Question 17 Use the following data for the next 4 questions: (Take a note of the information of your cale the last question) Debt 20 bonds with 8 % coupon rate, payable annually, $1,000 par value, 15 years to maturity, selling at $970 per bond. Common Stock 500 shares of common stock outstanding. The stock sells for a price of $112 per share and has a beta of 1.6 Preferred Stock 110 preferred shares outstanding, currently trading at $120 per share; with an annual dividend payment of $7 Market The market risk premium is 9% and the risk free rate is 2% Tax Rate 21% What is the cost of debt? (You don't need to calculate anything here. Use the logic of the 2nd key relationsh (You may not need all the information from above to answer this question) 6.55 % 8.36% Market The market risk premium is 9% and the risk free rate is 2% Tax Rate 2196 What is the cost of debt? (You don't need to calculate anything here. Use the logic of the 2nd key relationship on the slide) (You may not need all the information from above to answer this question) 6.55 % 8.36% 7.50 % 6.90 % Moving to another question will save this response. MacBook Market The market risk premium is 9% and the risk free rate is 2% Tax Rate 2196 What is the cost of common equity? (You may not need all the information from above to answer this question) Cost of common equity: K. - D.(1+) +9 Pc Return or Cost of common equity: E(y) = y + B[E() - D Cost of Preferred Stock: rp. Value of Preferred Stock WACC = W..K.(1 - 7) + W... Kes + W. K. 16.40 % 10.90 % 15.10 % 18.3696 A Moving to another question will save this response. MacBook Market The market risk premium is 9% and the risk free rate is 2% Tax Rate 2196 What is the cost of preferred equity? (You may not need all the information from above to answer this question) Cost of common equity: Kc = D.(1+9) Pc + 9 Return or Cost of common equity: E() = ry+B[E() - ry] Dps Cost of Preferred Stock: Tips Value of Preferred Stock WACC = W..K.(1-T) + W. * Kcs + Wps Kp. 9.33 % 5.83 % 7.45% 8.40 % A Manding to another austion will save this response MacBook 17 18 19 20 Tax Rate 2198 Calculate WACC? Cost of common equity: K. = Do(1+0) +9 Pc Return or Cost of common equity: E() = r+B[E(X) - r I Cost of Preferred Stock: rp. Dp Value of Preferred Stock WACC = W. Kd(1-T) + W. Ko + W. Kp. 15.53 % 13.55% 14.50 % 12.68 % A Click Submit to complete this assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts