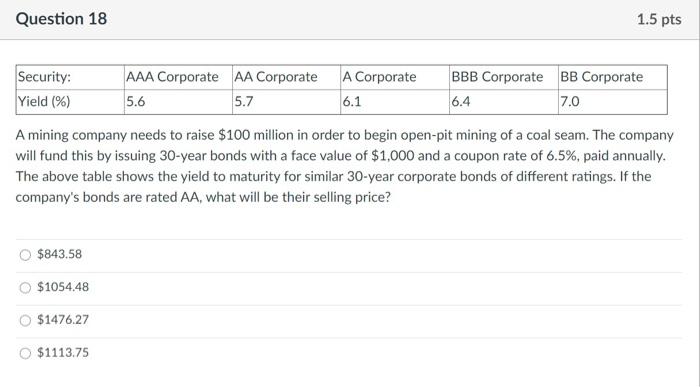

Question: Question 18 1.5 pts Security: Yield (%) AAA Corporate AA Corporate 5.6 5.7 A Corporate 6.1 BBB Corporate BB Corporate 6.4 7.0 A mining company

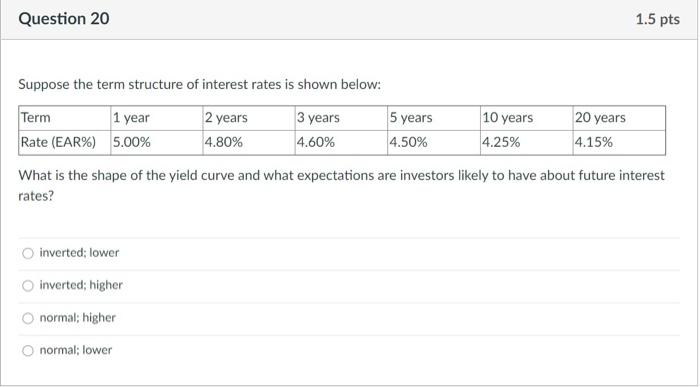

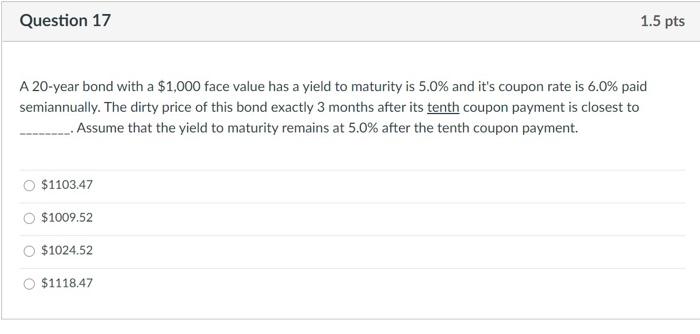

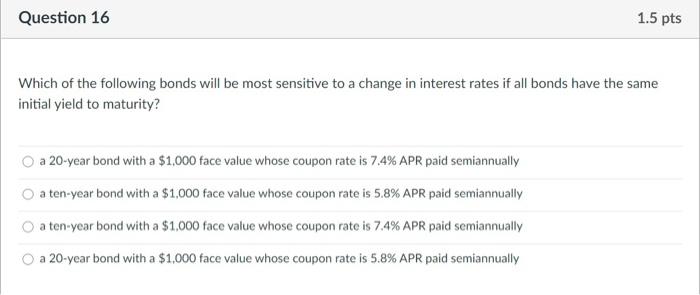

Question 18 1.5 pts Security: Yield (%) AAA Corporate AA Corporate 5.6 5.7 A Corporate 6.1 BBB Corporate BB Corporate 6.4 7.0 A mining company needs to raise $100 million in order to begin open-pit mining of a coal seam. The company will fund this by issuing 30-year bonds with a face value of $1,000 and a coupon rate of 6.5%, paid annually. The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings. If the company's bonds are rated AA, what will be their selling price? $843.58 $1054.48 $1476.27 $1113.75 Question 20 1.5 pts Suppose the term structure of interest rates is shown below: Term 1 year 2 years 3 years 5 years 10 years 20 years Rate (EAR%) 5.00% 4.80% 4.60% 4.50% 4.25% 4.15% What is the shape of the yield curve and what expectations are investors likely to have about future interest rates? inverted; lower inverted; higher normal; higher normal; lower Question 17 1.5 pts A 20-year bond with a $1,000 face value has a yield to maturity is 5.0% and it's coupon rate is 6.0% paid semiannually. The dirty price of this bond exactly 3 months after its tenth coupon payment is closest to .... Assume that the yield to maturity remains at 5.0% after the tenth coupon payment. $1103.47 $1009.52 $1024.52 $1118.47 Question 16 1.5 pts Which of the following bonds will be most sensitive to a change in interest rates if all bonds have the same initial yield to maturity? a 20-year bond with a $1,000 face value whose coupon rate is 7.4% APR paid semiannually a ten-year bond with a $1,000 face value whose coupon rate is 5.8% APR paid semiannually a ten-year bond with a $1.000 face value whose coupon rate is 7.4% APR paid semiannually a 20-year bond with a $1,000 face value whose coupon rate is 5.8% APR paid semiannually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts