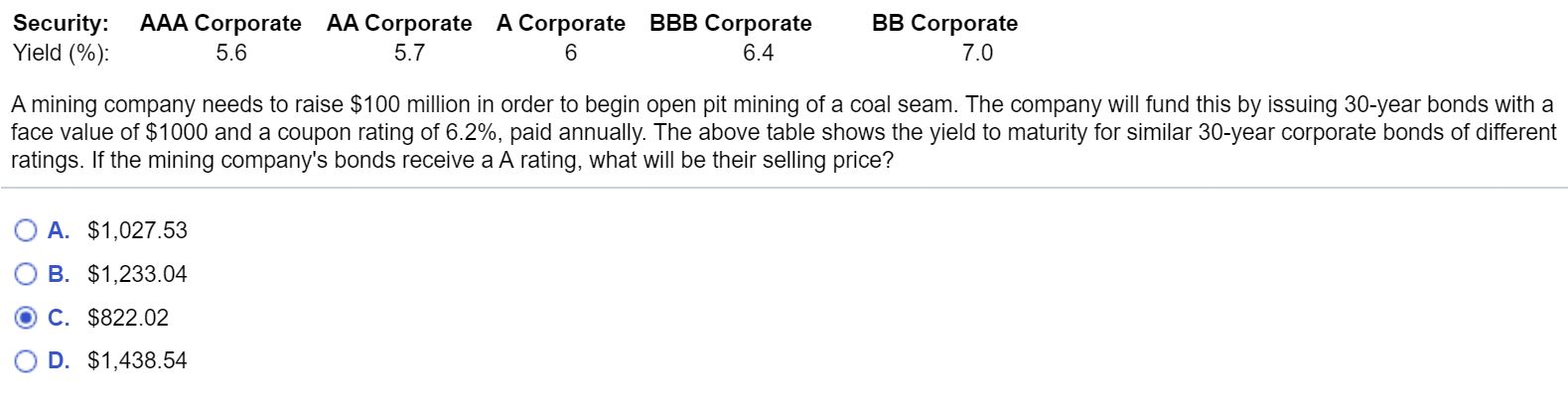

Question: Security: Yield (%): AAA Corporate AA Corporate A Corporate BBB Corporate 5.6 5.7 6 6.4 BB Corporate 7.0 A mining company needs to raise $100

Security: Yield (%): AAA Corporate AA Corporate A Corporate BBB Corporate 5.6 5.7 6 6.4 BB Corporate 7.0 A mining company needs to raise $100 million in order to begin open pit mining of a coal seam. The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6.2%, paid annually. The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings. If the mining company's bonds receive a A rating, what will be their selling price? A. $1,027.53 B. $1,233.04 C. $822.02 D. $1,438.54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts