Question: QUESTION 18 Consider a five-year project with the following information: initial fixed asset investment = $420,000; straight-line depreciation to zero over the five-year life; zero

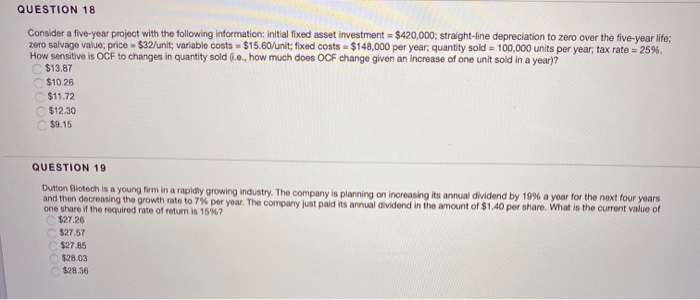

QUESTION 18 Consider a five-year project with the following information: initial fixed asset investment = $420,000; straight-line depreciation to zero over the five-year life; zero salvage value; price - $32/unit; variable costs = $15.60/unit:fixed costs - $148,000 per year; quantity sold = 100,000 units per year, tax rate=25% How sensitive is OCF to changes in quantity sold (.o., how much does OCF change given an increase of one unit sold in a year)? $13.87 $10.26 $11.72 $12.30 $9.15 QUESTION 19 Dutton Biotech is a young firm in a rapidly growing industry. The company is planning on increasing its annual dividend by 19% a year for the next four years and then decreasing the growth rate to 7% per year. The company just paid its annual dividend in the amount of $1.40 per share. What is the current value of one share if the required rate of return is 15%? $27.26 $27.57 $27.85 $28.03 $28.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts