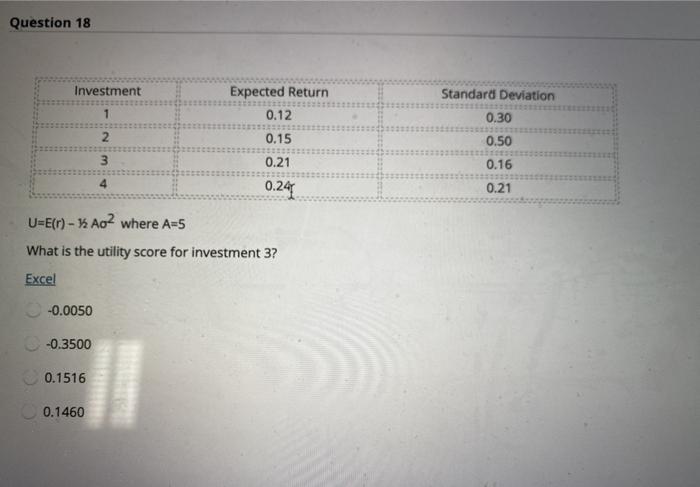

Question: Question 18 Investment Expected Return 0.12 1 0.15 Standard Deviation 0.30 0.50 0.16 0.21 0.21 0.24 4 U=E() - 12 Ao2 where A=5 What is

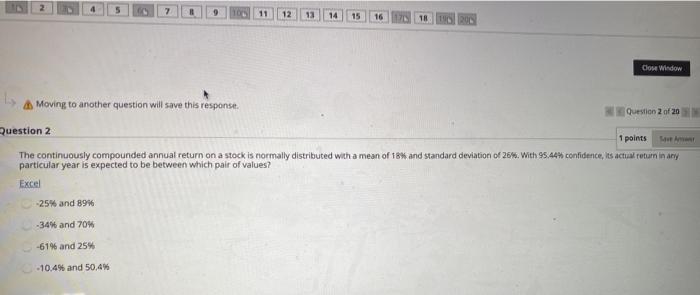

Question 18 Investment Expected Return 0.12 1 0.15 Standard Deviation 0.30 0.50 0.16 0.21 0.21 0.24 4 U=E() - 12 Ao2 where A=5 What is the utility score for investment 3? Excel -0.0050 -0.3500 0.1516 0.1460 7 9 100 11 12 13 14 15 TR 200 Cose Window Moving to another question will save this response. Question 2 of 20 Question 2 1 points The continuously compounded annual return on a stock is normally distributed with a mean of 18% and standard deviation of 26%. With 95.44% confidence, les actual return in any particular year is expected to be between which pair of values? Excel -25% and 894 -34 and 70% -61% and 25% -10.4% and 50,4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts