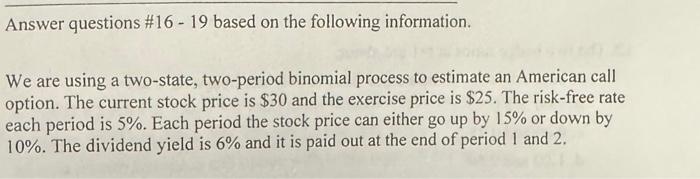

Question: question 18-19 are based on the info below! please read and solve both if possible. thank you Answer questions #16 - 19 based on the

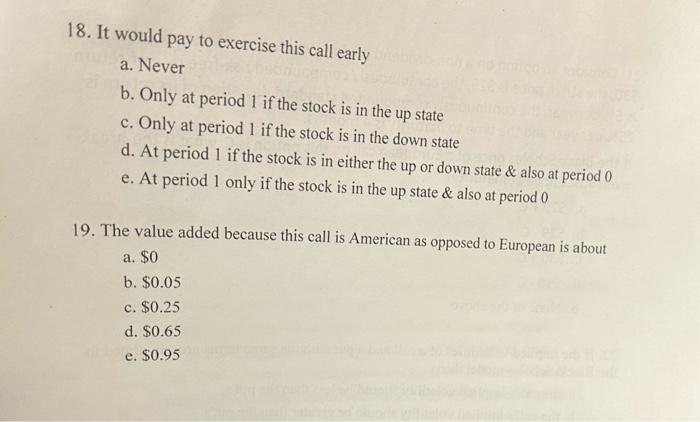

Answer questions \#16 - 19 based on the following information. We are using a two-state, two-period binomial process to estimate an American call option. The current stock price is $30 and the exercise price is $25. The risk-free rate each period is 5%. Each period the stock price can either go up by 15% or down by 10%. The dividend yield is 6% and it is paid out at the end of period 1 and 2 . 18. It would pay to exercise this call early a. Never b. Only at period 1 if the stock is in the up state c. Only at period 1 if the stock is in the down state d. At period 1 if the stock is in either the up or down state \& also at period 0 e. At period 1 only if the stock is in the up state \& also at period 0 19. The value added because this call is American as opposed to European is about a. $0 b. $0.05 c. $0.25 d. $0.65 e. $0.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts