Question: Question 19 (1 point) Peter recently installed a new equipment in his hardware store that cost $2,500. This equipment can be used for four years,

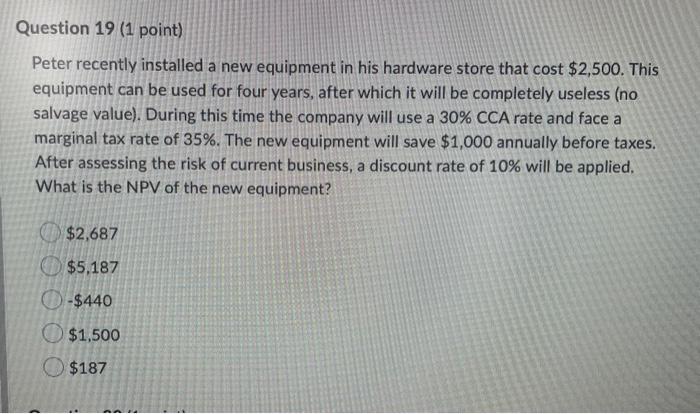

Question 19 (1 point) Peter recently installed a new equipment in his hardware store that cost $2,500. This equipment can be used for four years, after which it will be completely useless (no salvage value). During this time the company will use a 30% CCA rate and face a marginal tax rate of 35%. The new equipment will save $1,000 annually before taxes. After assessing the risk of current business, a discount rate of 10% will be applied. What is the NPV of the new equipment? $2,687 $5,187 0-$440 $1,500 $187

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock