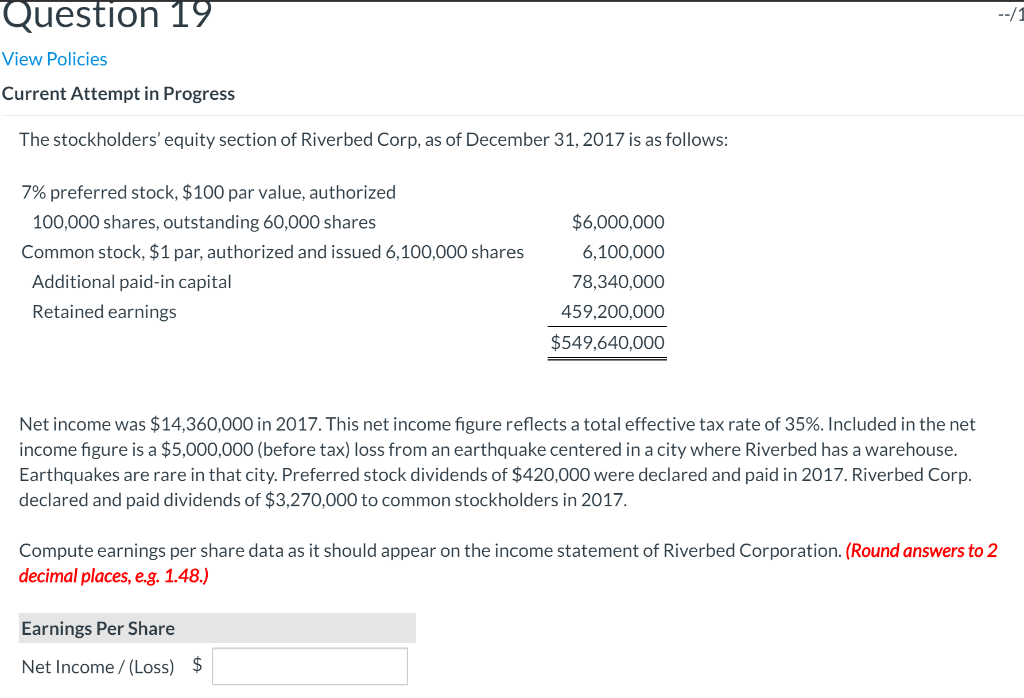

Question: Question 19 --/1 View Policies Current Attempt in Progress The stockholders' equity section of Riverbed Corp, as of December 31, 2017 is as follows: 7%

Question 19 --/1 View Policies Current Attempt in Progress The stockholders' equity section of Riverbed Corp, as of December 31, 2017 is as follows: 7% preferred stock, $100 par value, authorized 100,000 shares, outstanding 60,000 shares Common stock, $1 par, authorized and issued 6,100,000 shares Additional paid-in capital Retained earnings $6,000,000 6,100,000 78,340,000 459,200,000 $549,640,000 Net income was $14,360,000 in 2017. This net income figure reflects a total effective tax rate of 35%. Included in the net income figure is a $5,000,000 (before tax) loss from an earthquake centered in a city where Riverbed has a warehouse. Earthquakes are rare in that city. Preferred stock dividends of $420,000 were declared and paid in 2017. Riverbed Corp. declared and paid dividends of $3,270,000 to common stockholders in 2017. Compute earnings per share data as it should appear on the income statement of Riverbed Corporation. (Round answers to 2 decimal places, e.g. 1.48.) Earnings Per Share Net Income /(Loss) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts