Question: Question 19 (3 points) The long-term historical record (from 1926 through the past few years) of investment returns in the U.S. shows large company stocks

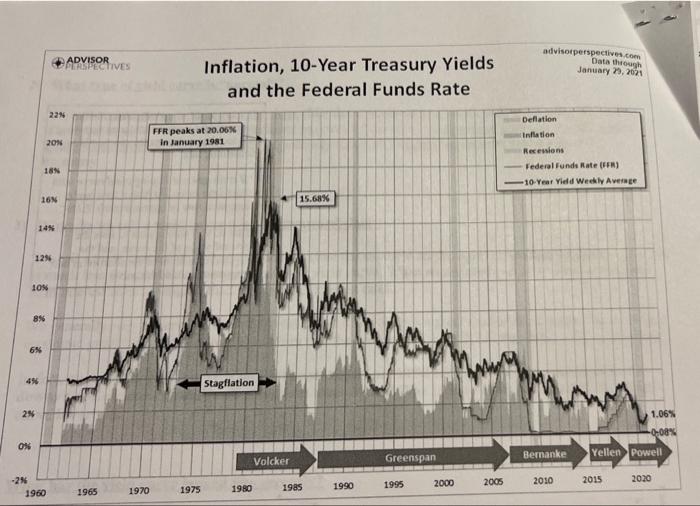

Question 19 (3 points) The long-term historical record (from 1926 through the past few years) of investment returns in the U.S. shows large company stocks have produced higher returns than small company stocks, and shorter-term bonds have produced higher returns than long-term bonds. small company stocks have produced higher returns than large company stocks, and longer-term bonds have produced higher returns than short-term bonds. O small company stocks have produced higher returns than large company stocks, and shorter-term bonds have produced higher returns than long-term bonds. large company stocks have produced higher returns than small company stocks, and longer-term bonds have produced higher returns than short-term bonds. 4% 0% -2% 6% 2% 12% 22% 20% 18% 16% 14% 10% 8% 1960 ADVISOR PERSPECTIVES 1965 1970 Inflation, 10-Year Treasury Yields and the Federal Funds Rate 15.68% FFR peaks at 20.06% in January 1981 1975 Stagflation 1980 BAJ Volcker 1985 1990 Greenspan 1995 2000 2005 advisorperspectives.com Data through January 29, 2021 Deflation Inflation Recessions Federal Funds Rate (FFR) 10-Year Yield Weekly Average Bernanke 2010 1.06% -0.08% Yellen Powell 2020 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts