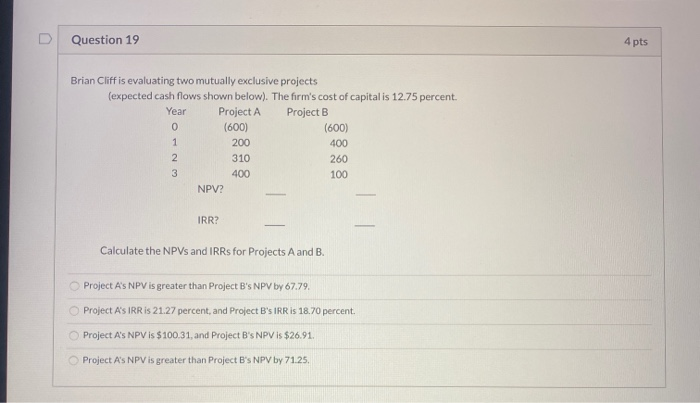

Question: Question 19 4 pts Brian Cliff is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 12.75 percent.

Question 19 4 pts Brian Cliff is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 12.75 percent. Year Project A Project B (600) (600) 200 400 310 260 400 NPV? WN IRR? Calculate the NPVs and IRRs for Projects A and B. Project A's NPV is greater than Project B's NPV by 67.79. Project A's IRR is 21.27 percent, and Project B's IRR is 18.70 percent. Project A's NPV is $100.31, and Project B's NPV is $26.91. Project A's NPV is greater than Project B's NPV by 71.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts