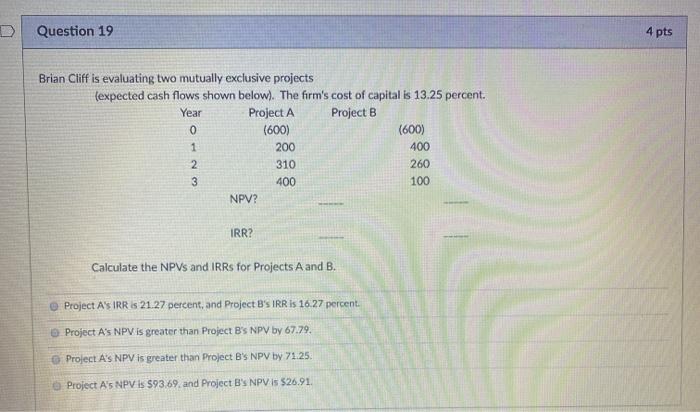

Question: D Question 19 4 pts Brian Cliff is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 13.25

D Question 19 4 pts Brian Cliff is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 13.25 percent. Year Project A Project B 0 (600) (600) 1 200 400 2 310 260 3 400 100 NPV? IRR? Calculate the NPVs and IRRs for Projects A and B. e Project A'SIRR is 21.27 percent, and Project B's IRR IS 1627 percent. Project A's NPV is greater than Project B's NPV by 67.79. Project A's NPV is greater than Project B's NPV by 71.25 Project A's NPV is 593.69 and Project By NPV is $26.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts