Question: Question 19 4 pts Your Aunt Molly has found a $1,000 par, 13.5% annual coupon bond that matures in 30 years which is currently selling

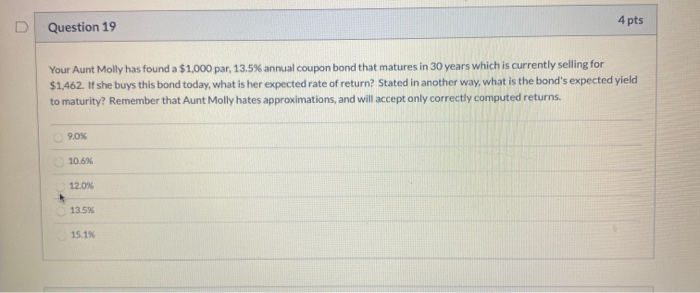

Question 19 4 pts Your Aunt Molly has found a $1,000 par, 13.5% annual coupon bond that matures in 30 years which is currently selling for $1,462. If she buys this bond today, what is her expected rate of return? Stated in another way, what is the bond's expected yield to maturity? Remember that Aunt Molly hates approximations, and will accept only correctly computed returns. 9.0% 10.6% 12.0% 13.5% 15.1%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock