Question: Question 19) A zero coupon bond has 5 years to maturity and face value of $1000. The current yield of the bond is 2.8%. Suppose

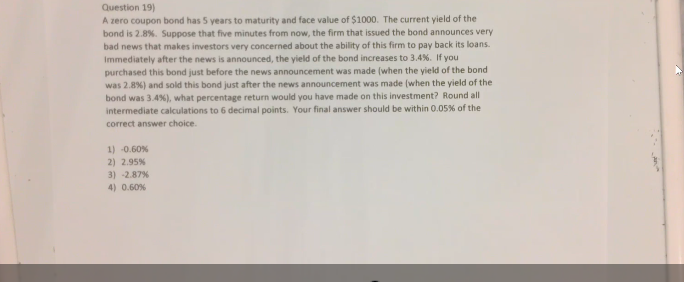

Question 19) A zero coupon bond has 5 years to maturity and face value of $1000. The current yield of the bond is 2.8%. Suppose that five minutes from now, the firm that issued the bond announces very bad news that makes investors very concerned about the ability of this firm to pay back its loans. Immediately after the news is announced, the yield of the bond increases to 3.4%. If you purchased this bond just before the news announcement was made (when the yield of the bond was 2.8% ) and sold this bond just after the news announcement was made (when the yield of the bond was 3.4% ), what percentage return would you have made on this investment? Round all intermediate calculations to 6 decimal points. Your final answer should be within 0.05% of the correct answer choice. 1) 0.60% 2) 2.95% 3) 2.87% 4) 0.60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts