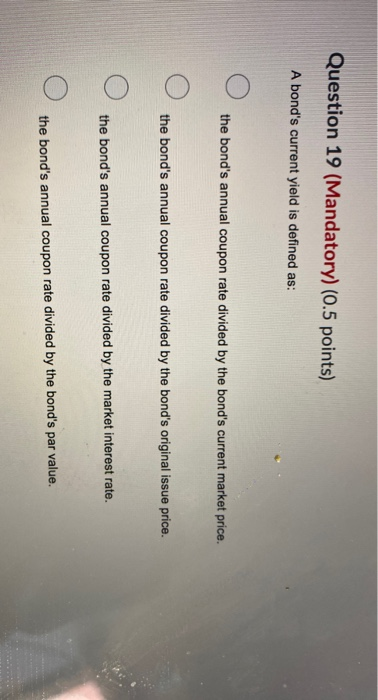

Question: Question 19 (Mandatory) (0.5 points) A bond's current yield is defined as: the bond's annual coupon rate divided by the bond's current market price. O

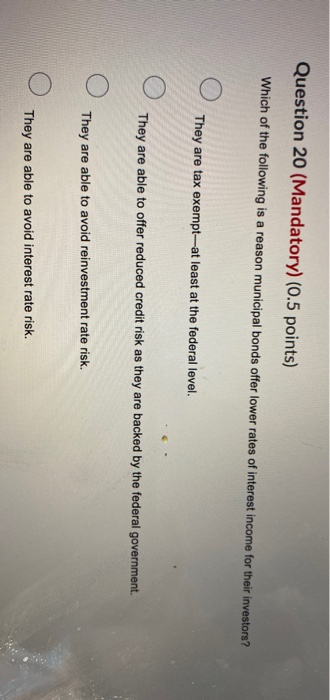

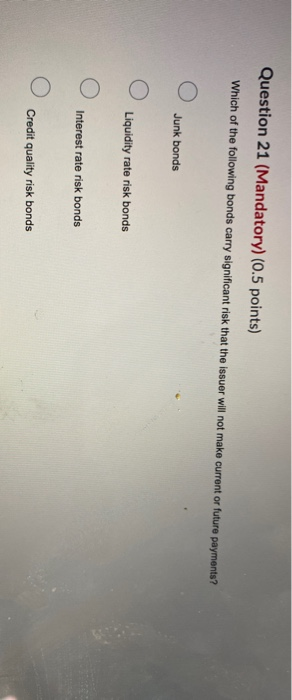

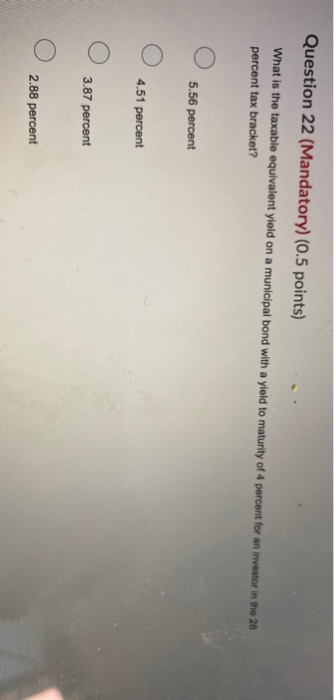

Question 19 (Mandatory) (0.5 points) A bond's current yield is defined as: the bond's annual coupon rate divided by the bond's current market price. O the bond's annual coupon rate divided by the bond's original issue price. O the bond's annual coupon rate divided by the market interest rate. O the bond's annual coupon rate divided by the bond's par value. Question 20 (Mandatory) (0.5 points) Which of the following is a reason municipal bonds offer lower rates of interest income for their investors? They are tax exemptat least at the federal level. They are able to offer reduced credit risk as they are backed by the federal government. They are able to avoid reinvestment rate risk. They are able to avoid interest rate risk. Question 21 (Mandatory) (0.5 points) Which of the following bonds carry significant risk that the issuer will not make current or future payments? O O Junk bonds Liquidity rate risk bonds O Interest rate risk bonds O Credit quality risk bonds Question 22 (Mandatory) (0.5 points) What is the taxable equivalent yield on a municipal bond with a yield to maturity of 4 percent for an investor in the 28 percent tax bracket? U 5.56 percent 4.51 percent O 3.87 percent O 2.88 percent O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts