Question: Suppose the S&R index is 800 , the continuously compounded risk-free rate is 5%, and the dividend yield is 0%. A 1-year 815-strike European call

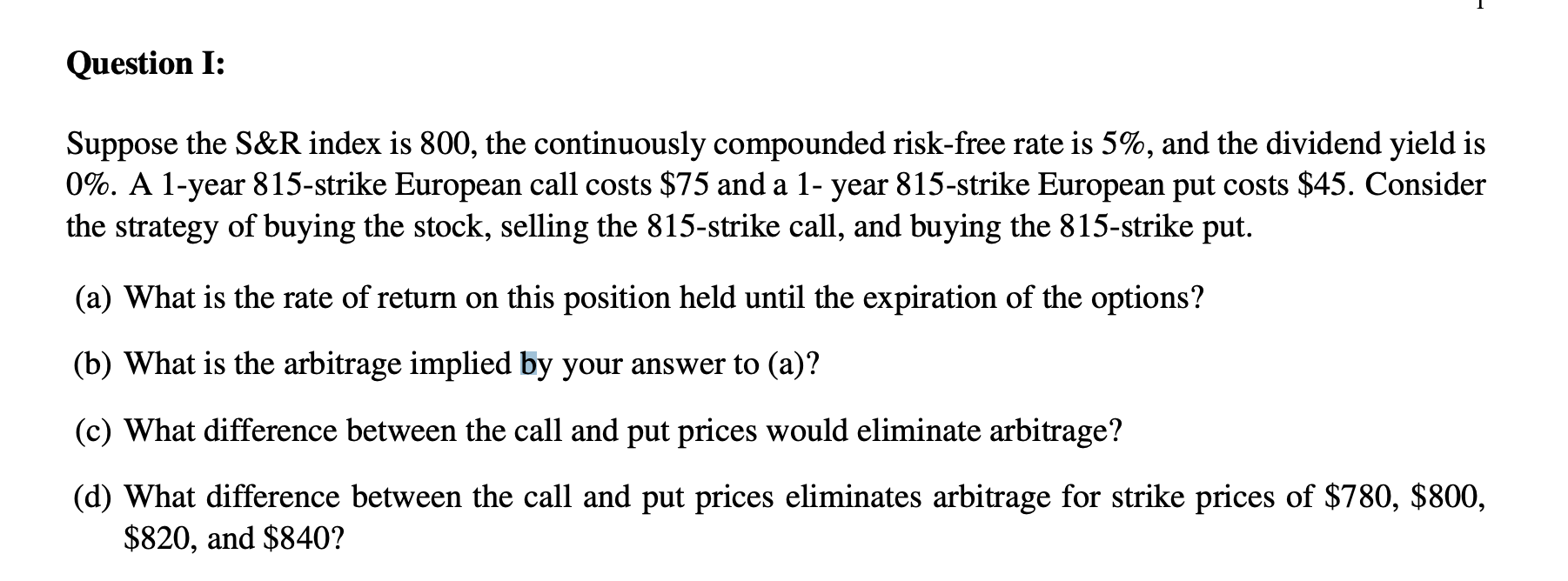

Suppose the S\&R index is 800 , the continuously compounded risk-free rate is 5%, and the dividend yield is 0%. A 1-year 815-strike European call costs $75 and a 1- year 815 -strike European put costs $45. Consider the strategy of buying the stock, selling the 815 -strike call, and buying the 815-strike put. (a) What is the rate of return on this position held until the expiration of the options? (b) What is the arbitrage implied by your answer to (a)? (c) What difference between the call and put prices would eliminate arbitrage? (d) What difference between the call and put prices eliminates arbitrage for strike prices of $780, $800, $820, and $840

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts