Question: QUESTION 19 When using the allowance method for accounting for bad debts, accounts receivable is reported on the balance sheet at the expected net realizable

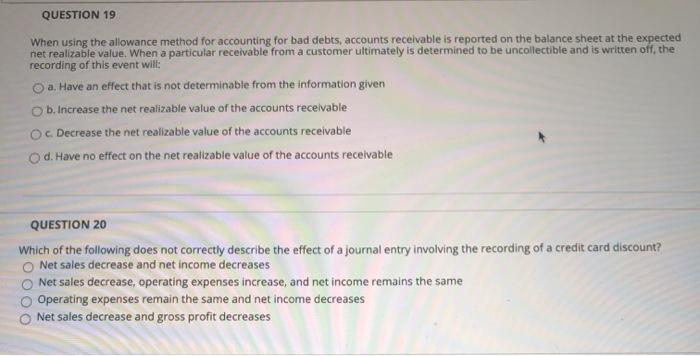

QUESTION 19 When using the allowance method for accounting for bad debts, accounts receivable is reported on the balance sheet at the expected net realizable value. When a particular receivable from a customer ultimately is determined to be uncollectible and is written off the recording of this event wilt: a. Have an effect that is not determinable from the information given b. Increase the net realizable value of the accounts receivable c. Decrease the net realizable value of the accounts receivable d. Have no effect on the net realizable value of the accounts receivable QUESTION 20 Which of the following does not correctly describe the effect of a journal entry involving the recording of a credit card discount? Net sales decrease and net income decreases Net sales decrease, operating expenses increase, and net income remains the same Operating expenses remain the same and net income decreases Net sales decrease and gross profit decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts