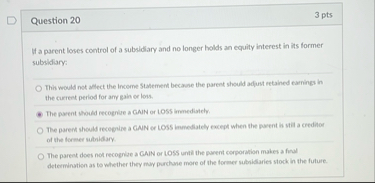

Question: Question 2 0 3 pts If a parent loses control of a subsidiary and no longer holds an equity interest in its former subsidiary: This

Question

pts

If a parent loses control of a subsidiary and no longer holds an equity interest in its former subsidiary:

This would not alfect the income Statement because the parent should adjust retained earning in the current period for any gain or lows.

The parent thoudd recognite a GAIN or LOSS inmediately.

The parent should receguipe a GAN or LOSS inmediately exept when the parent is still a creditor of the former subnidiary.

The parent does not recopidae a GAIN or LOSS uniti the parent corporation makes a frod determination as to whether they may porchane more of the former subsidiaries stock in the future.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock