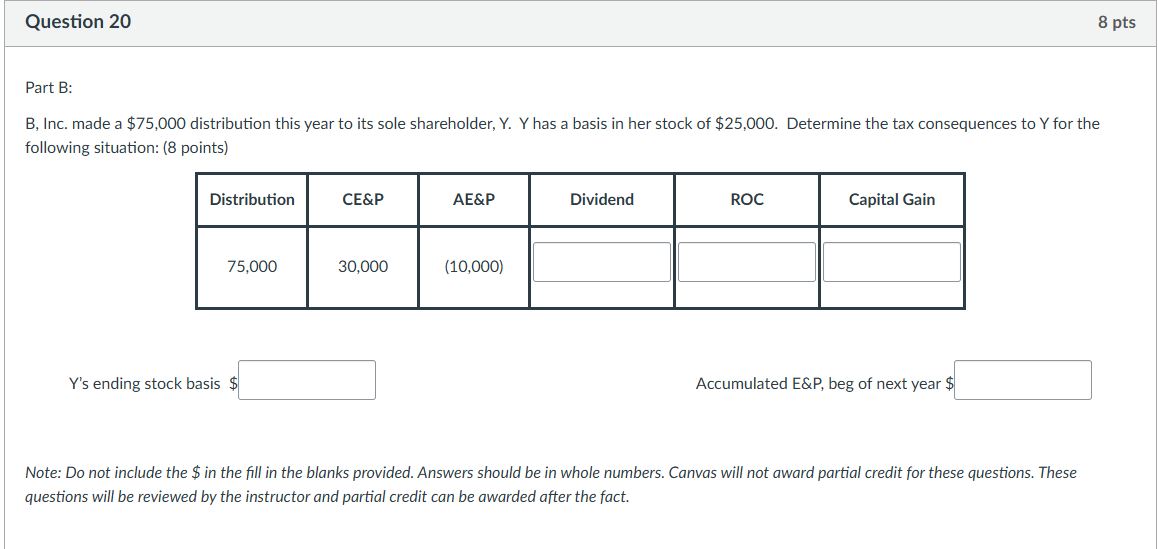

Question: Question 2 0 Part B: B , Inc. made a ( $ 7 5 , 0 0 0 ) distribution this year

Question Part B: B Inc. made a $ distribution this year to its sole shareholder, Y Y has a basis in her stock of $ Determine the tax consequences to Y for the following situation: points Ys ending stock basis $ Accumulated E&P beg of next year $ Note: Do not include the $ in the fill in the blanks provided. Answers should be in whole numbers. Canvas will not award partial credit for these questions. These questions will be reviewed by the instructor and partial credit can be awarded after the fact.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock