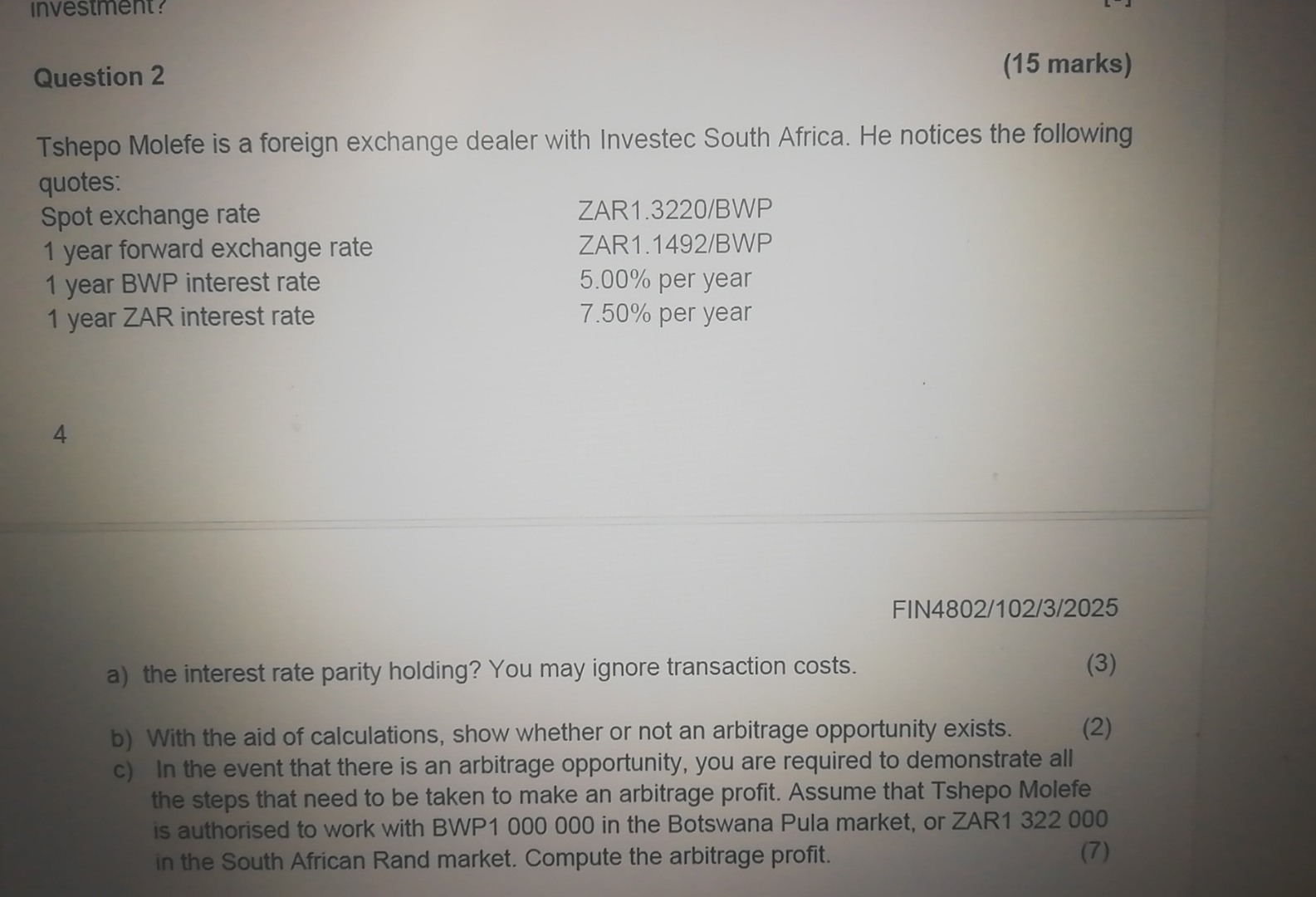

Question: Question 2 ( 1 5 marks ) Tshepo Molefe is a foreign exchange dealer with Investec South Africa. He notices the following quotes: table

Question

marks

Tshepo Molefe is a foreign exchange dealer with Investec South Africa. He notices the following quotes:

tableSpot exchange rate,ZARBWP year forward exchange rate,ZARBWP year BWP interest rate, per year year ZAR interest rate, per year

FIN

a the interest rate parity holding? You may ignore transaction costs.

b With the aid of calculations, show whether or not an arbitrage opportunity exists.

c In the event that there is an arbitrage opportunity, you are required to demonstrate all the steps that need to be taken to make an arbitrage profit. Assume that Tshepo Molefe is authorised to work with BWP in the Botswana Pula market, or ZAR in the South African Rand market. Compute the arbitrage profit.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock