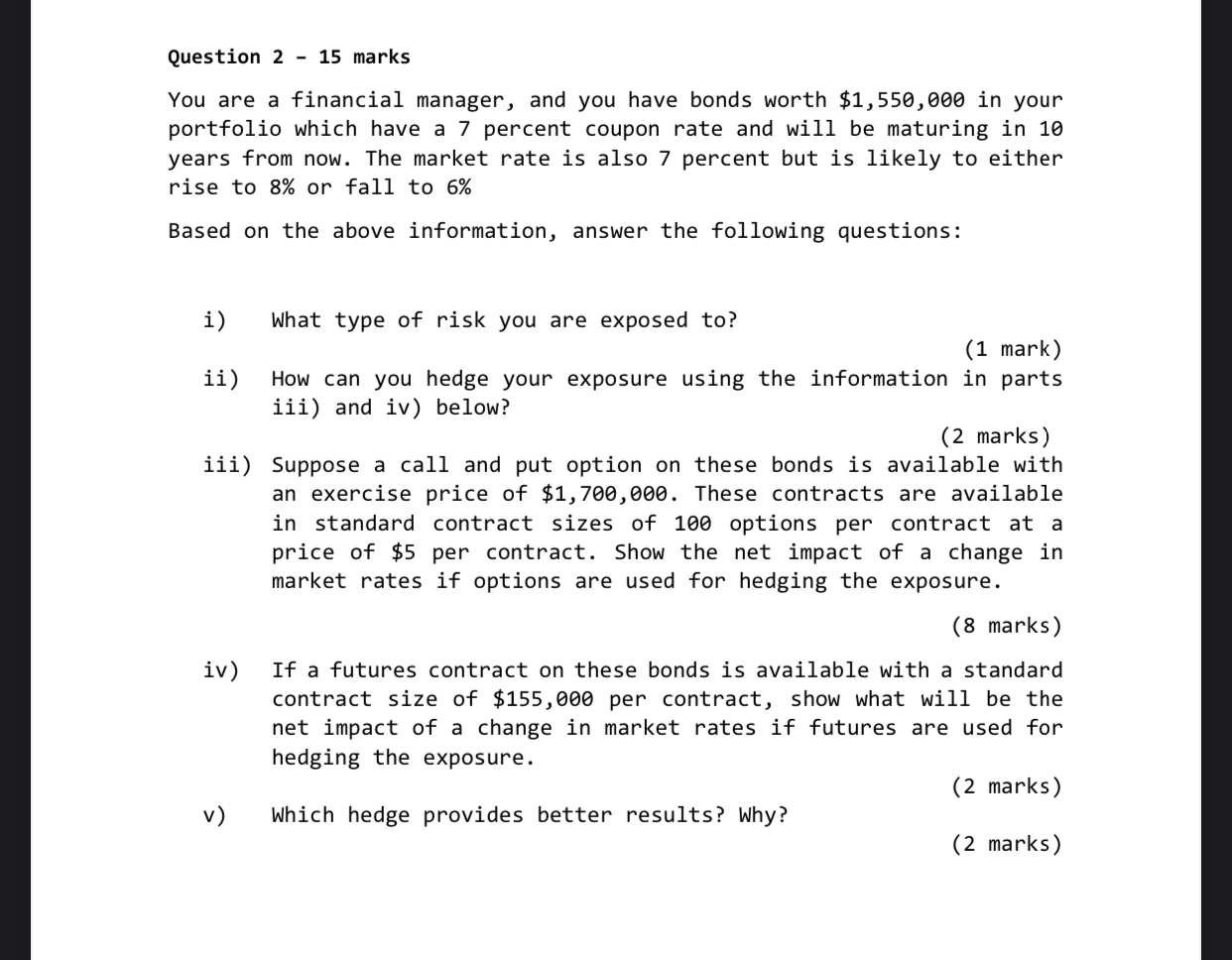

Question: Question 2 - 1 5 marks You are a financial manager, and you have bonds worth $ 1 , 5 5 0 , 0 0

Question marks

You are a financial manager, and you have bonds worth $ in your portfolio which have a percent coupon rate and will be maturing in years from now. The market rate is also percent but is likely to either rise to or fall to

Based on the above information, answer the following questions:

i What type of risk you are exposed to

mark

ii How can you hedge your exposure using the information in parts iii and iv below?

marks

iii Suppose a call and put option on these bonds is available with an exercise price of $ These contracts are available in standard contract sizes of options per contract at a price of $ per contract. Show the net impact of a change in market rates if options are used for hedging the exposure.

marks

iv If a futures contract on these bonds is available with a standard contract size of $ per contract, show what will be the net impact of a change in market rates if futures are used for hedging the exposure.

v Which hedge provides better results? Why?

marks

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock