Question: QUESTION 2 (10%) Assume the proposed Webstore system has a productive life of 5 years, with projected sales income at RM 80,000 per year,

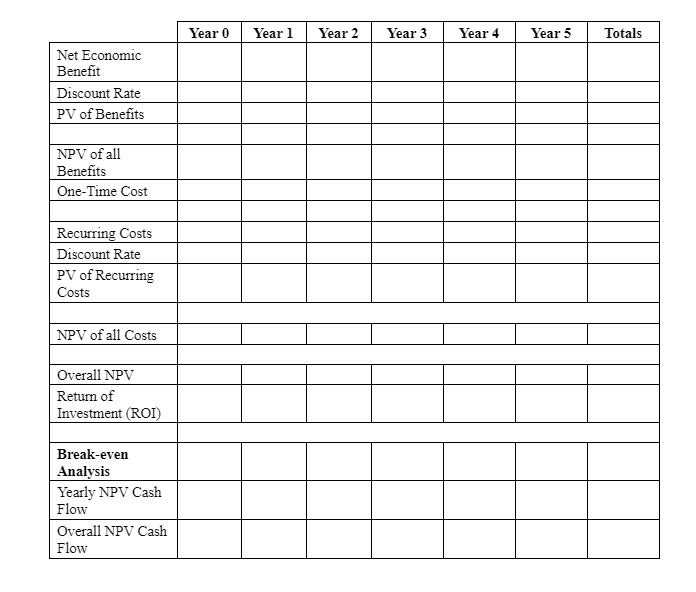

QUESTION 2 (10%) Assume the proposed Webstore system has a productive life of 5 years, with projected sales income at RM 80,000 per year, one-time server setup cost of RM65,000 and a recurring cost of RM 40,000 per year. If the discount rate is 12%, calculate the following: a) Net Present Value (NPV) of these costs and benefits of the web store based on the sheet given in the answer sheet. b) Do you think this project is worth to proceed? Justify your answer based on economic feasibility and break-even analysis. Note: Please round to the nearest TWO(2) decimal places for discount rate and the nearest integer value for Present Value (PV). Net Economic Benefit Discount Rate PV of Benefits NPV of all Benefits One-Time Cost Recurring Costs Discount Rate PV of Recurring Costs NPV of all Costs Overall NPV Return of Investment (ROI) Break-even Analysis Yearly NPV Cash Flow Overall NPV Cash Flow Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Totals

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

STEP... View full answer

Get step-by-step solutions from verified subject matter experts