Suppose you are the manager of an investment fund. The fund is invested in following three...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

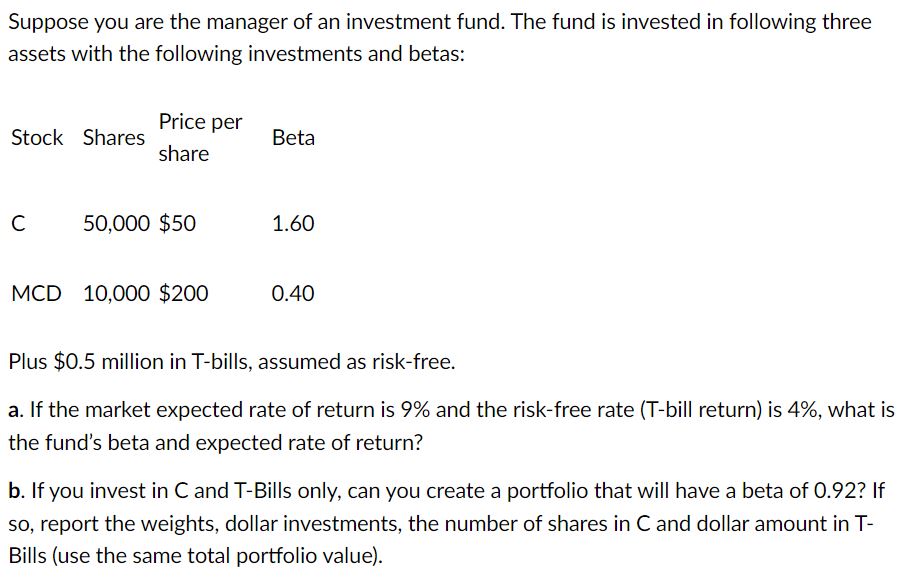

Suppose you are the manager of an investment fund. The fund is invested in following three assets with the following investments and betas: Stock Shares C Price per share 50,000 $50 MCD 10,000 $200 Beta 1.60 0.40 Plus $0.5 million in T-bills, assumed as risk-free. a. If the market expected rate of return is 9% and the risk-free rate (T-bill return) is 4%, what is the fund's beta and expected rate of return? b. If you invest in C and T-Bills only, can you create a portfolio that will have a beta of 0.92? If so, report the weights, dollar investments, the number of shares in C and dollar amount in T- Bills (use the same total portfolio value). Suppose you are the manager of an investment fund. The fund is invested in following three assets with the following investments and betas: Stock Shares C Price per share 50,000 $50 MCD 10,000 $200 Beta 1.60 0.40 Plus $0.5 million in T-bills, assumed as risk-free. a. If the market expected rate of return is 9% and the risk-free rate (T-bill return) is 4%, what is the fund's beta and expected rate of return? b. If you invest in C and T-Bills only, can you create a portfolio that will have a beta of 0.92? If so, report the weights, dollar investments, the number of shares in C and dollar amount in T- Bills (use the same total portfolio value).

Expert Answer:

Answer rating: 100% (QA)

a To calculate the funds beta and expected rate of return we need to use the formula for the expected return of a portfolio Expected Return RiskFree R... View the full answer

Related Book For

Financial Theory and Corporate Policy

ISBN: 978-0321127211

4th edition

Authors: Thomas E. Copeland, J. Fred Weston, Kuldeep Shastri

Posted Date:

Students also viewed these finance questions

-

Suppose you are the manager of an investment fund in a two-parameter economy. Given the following forecast: E(Rm) = .16, (Rm) = .20, Rf = .08 (a) Would you recommend investment in a security with...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

As indicated in the chapter, ROI is well entrenched in business practice. However, its use can have negative incentive effects on managerial behavior. For example, assume you are the manager of an...

-

The values of Alabama building contracts (in millions of dollars) for a 12-month period follow: 240 350 230 260 280 320 220 310 240 310 240 230 a. Construct a time series plot. What type of pattern...

-

The bookkeeper for Reliable Computers, Inc., reports the following balance sheet amounts as of June 30, 2008. Current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

William is not married, nor does he have any dependents. He does not itemize deductions. His taxable income for 2021 was $87,000 and his regular tax was $14,907. His AMT adjustments totaled $125,000....

-

Plaintiff contracted to install a boiler for defendant. After plaintiff had installed and tested the boiler, but before final payment to plaintiff had been made, defendant took custody of the boiler...

-

The adjusted trial balance of Karise Repairs on December 31, 2013, follows. Required 1. Prepare an income statement and a statement of owners equity for the year 2013, and a classified balance sheet...

-

Dr. Jose Rizals arrest, exile, trial, and eventual execution, primarily, was the result of his two books namely, Noli Me Tngere, and El Filibusterismo. However, his protagonist Crisostomo Ibarra,...

-

Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21- 3434) have a 19-year-old son (born 10/2/99 Social Security...

-

Nitai, who is single and has no dependents, was planning on spending the weekend repairing his car. On Friday, Nitai's employer called and offered him $350 in overtime pay if he would agree to work...

-

Based on the marketing journal : Attracting Students to Sales Positions: The Case of Effective Salesperson Recruitment Ads Please answer in essay format: Question: a. What evidence from the article...

-

Identify and describe the three basic forms of business organizations. What are the advantages and disadvantages of each form of ownership? Distinguished-level: Business entities can also be...

-

Grant borrowed $5,300 to remodel his bathroom, he agreed to make 30 monthly payments of $235. He payed it off in 24 months. What is the amount neede to repay the loan in full using the rule of 78?

-

Why would management be concerned about the accuracy of product cost? how do the multiple production department and the single plantwide factory overhead rate methods differ? How does activity based...

-

opened their *** on January 1, 2021. His records showed the following ledger balances on December 31, 2021. Accounts Payable Accounts Receivable Cash Advertising Fees Earned Advertising Supplies Used...

-

McKenna Michaels is a 30-year-old single taxpayer who changed jobs during the year. When she left her first job, she decided to take a total distribution from the 401(k) plan she had established with...

-

What is EBIT/eps analysis? What information does it provide managers?

-

What are the conditions under which an American put would be exercised early on a stock that pays no dividends?

-

The treasurer of United Southern Capital Co. has submitted a proposal to the board of directors that, he argues, will increase profits for the all-equity company by a whopping 55%. It costs $900 and...

-

According to federal tax law, corporations need not pay taxes on 80% of dividends received from shares held in other corporations. In other words, only 20% of the dividends received by a corporate...

-

What factors will make it difficult for Tesla to meet its stated objective of 5,000 Model 3 sedans per week? Explain why you think its stated objective should (or should not) have been different than...

-

What potential ethical issues do you see here? What are the strategic issues?

-

Should executives complete the strategic plan without input from other employees and managers? Why or why not?

Study smarter with the SolutionInn App