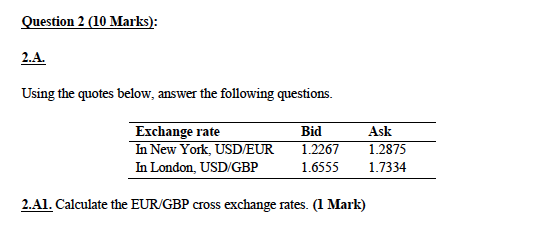

Question: Question 2 (10 Marks): 2.A. Using the quotes below, answer the following questions. Exchange rate In New York, USD/EUR In London, USD GBP Bid 1.2267

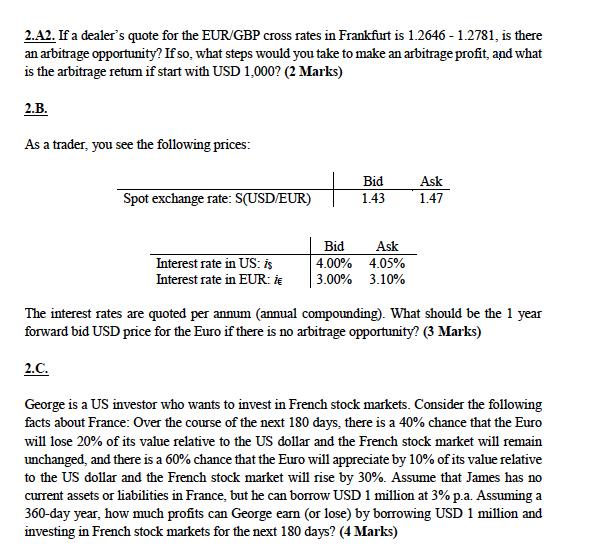

Question 2 (10 Marks): 2.A. Using the quotes below, answer the following questions. Exchange rate In New York, USD/EUR In London, USD GBP Bid 1.2267 1.6555 Ask 1.2875 1.7334 2.Al. Calculate the EUR/GBP cross exchange rates. (1 Mark) 2.A2. If a dealer's quote for the EUR/GBP cross rates in Frankfurt is 1.2646 - 1.2781, is there an arbitrage opportunity? If so, what steps would you take to make an arbitrage profit, and what is the arbitrage retum if start with USD 1,000? (2 Marks) 2.B. As a trader, you see the following prices: Bid 1.43 Spot exchange rate: S(USD/EUR) Ask 1.47 Ask Interest rate in US: is Interest rate in EUR: DE Bid 4.00% 4.05% 3.00% 3.10% The interest rates are quoted per annum (annual compounding). What should be the 1 year forward bid USD price for the Euro if there is no arbitrage opportunity? (3 Marks) 2.C. George is a US investor who wants to invest in French stock markets. Consider the following facts about France: Over the course of the next 180 days, there is a 40% chance that the Euro will lose 20% of its value relative to the US dollar and the French stock market will remain unchanged, and there is a 60% chance that the Euro will appreciate by 10% of its value relative to the US dollar and the French stock market will rise by 30%. Assume that James has no current assets or liabilities in France, but he can borrow USD 1 million at 3% p.a. Assuming a 360-day year, how much profits can George earn (or lose) by borrowing USD 1 million and investing in French stock markets for the next 180 days? (4 Marks) Question 2 (10 Marks): 2.A. Using the quotes below, answer the following questions. Exchange rate In New York, USD/EUR In London, USD GBP Bid 1.2267 1.6555 Ask 1.2875 1.7334 2.Al. Calculate the EUR/GBP cross exchange rates. (1 Mark) 2.A2. If a dealer's quote for the EUR/GBP cross rates in Frankfurt is 1.2646 - 1.2781, is there an arbitrage opportunity? If so, what steps would you take to make an arbitrage profit, and what is the arbitrage retum if start with USD 1,000? (2 Marks) 2.B. As a trader, you see the following prices: Bid 1.43 Spot exchange rate: S(USD/EUR) Ask 1.47 Ask Interest rate in US: is Interest rate in EUR: DE Bid 4.00% 4.05% 3.00% 3.10% The interest rates are quoted per annum (annual compounding). What should be the 1 year forward bid USD price for the Euro if there is no arbitrage opportunity? (3 Marks) 2.C. George is a US investor who wants to invest in French stock markets. Consider the following facts about France: Over the course of the next 180 days, there is a 40% chance that the Euro will lose 20% of its value relative to the US dollar and the French stock market will remain unchanged, and there is a 60% chance that the Euro will appreciate by 10% of its value relative to the US dollar and the French stock market will rise by 30%. Assume that James has no current assets or liabilities in France, but he can borrow USD 1 million at 3% p.a. Assuming a 360-day year, how much profits can George earn (or lose) by borrowing USD 1 million and investing in French stock markets for the next 180 days? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts