Question: Question #2 (10 marks) A put option to sell one share of stock has an exercise price of 100 and a time to maturity of

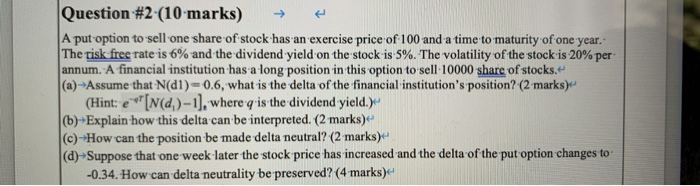

Question #2 (10 marks) A put option to sell one share of stock has an exercise price of 100 and a time to maturity of one year. The risk free rate is 6% and the dividend yield on the stock-is-5%. The volatility of the stock-is 20% per annum. A financial institution has a long position in this option to sell 10000 share of stocks. (a)--Assume that N(dl)-0.6, what is the delta of the financial institution's position? (2 marks) (Hint: e[n(d)-1], where q'is the dividend yield.) (b)-Explain how this delta can be interpreted. (2 marks) (c) How can the position be made delta neutral? (2 marks) (a)-Suppose that one week-later the stock price has increased and the delta of the put option changes to -0.34. How can delta neutrality be preserved? (4 marks) Question #2 (10 marks) A put option to sell one share of stock has an exercise price of 100 and a time to maturity of one year. The risk free rate is 6% and the dividend yield on the stock-is-5%. The volatility of the stock-is 20% per annum. A financial institution has a long position in this option to sell 10000 share of stocks. (a)--Assume that N(dl)-0.6, what is the delta of the financial institution's position? (2 marks) (Hint: e[n(d)-1], where q'is the dividend yield.) (b)-Explain how this delta can be interpreted. (2 marks) (c) How can the position be made delta neutral? (2 marks) (a)-Suppose that one week-later the stock price has increased and the delta of the put option changes to -0.34. How can delta neutrality be preserved? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts