Question: Question 2 (10 points) Given that there is a high demand for hand sanitizer, All Natural is considering venturing into this business. The initial investment

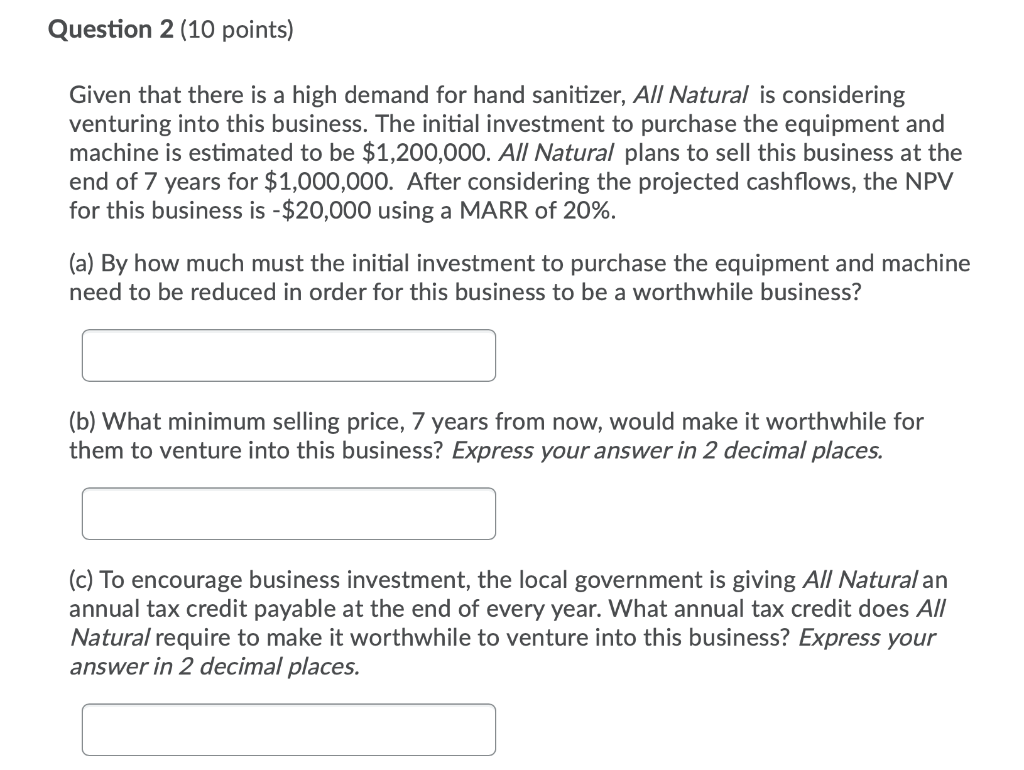

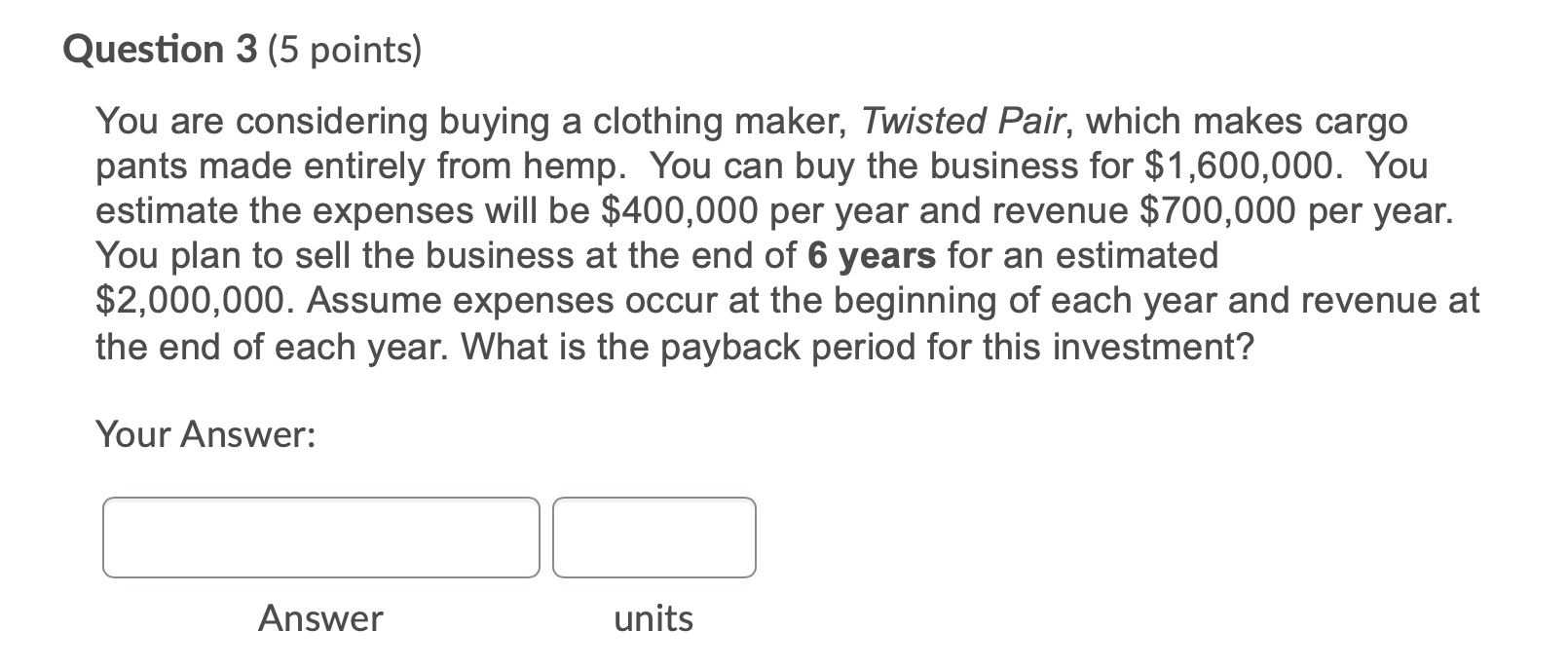

Question 2 (10 points) Given that there is a high demand for hand sanitizer, All Natural is considering venturing into this business. The initial investment to purchase the equipment and machine is estimated to be $1,200,000. All Natural plans to sell this business at the end of 7 years for $1,000,000. After considering the projected cashflows, the NPV for this business is -$20,000 using a MARR of 20%. (a) By how much must the initial investment to purchase the equipment and machine need to be reduced in order for this business to be a worthwhile business? (b) What minimum selling price, 7 years from now, would make it worthwhile for them to venture into this business? Express your answer in 2 decimal places. (c) To encourage business investment, the local government is giving All Natural an annual tax credit payable at the end of every year. What annual tax credit does All Natural require to make it worthwhile to venture into this business? Express your answer in 2 decimal places. Question 3 (5 points) You are considering buying a clothing maker, Twisted Pair, which makes cargo pants made entirely from hemp. You can buy the business for $1,600,000. You estimate the expenses will be $400,000 per year and revenue $700,000 per year. You plan to sell the business at the end of 6 years for an estimated $2,000,000. Assume expenses occur at the beginning of each year and revenue at the end of each year. What is the payback period for this investment? Your Answer: Answer units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts